- Countercyclical

-

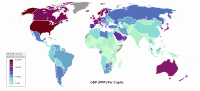

Economics  Economies by region

Economies by regionGeneral categories Microeconomics · Macroeconomics

History of economic thought

Methodology · Mainstream & heterodoxTechnical methods Mathematical economics

Game theory · Optimization

Computational · Econometrics

Experimental · National accountingFields and subfields Behavioral · Cultural · Evolutionary

Growth · Development · History

International · Economic systems

Monetary and Financial economics

Public and Welfare economics

Health · Education · Welfare

Population · Labour · Managerial

Business · Information

Industrial organization · Law

Agricultural · Natural resource

Environmental · Ecological

Urban · Rural · Regional · GeographyLists Business and Economics Portal Countercyclical is a term used in economics to describe how an economic quantity is related to economic fluctuations. It is the opposite of procyclical. However, it has more than one meaning.

Contents

Meaning in policy making

An economic or financial policy is called 'countercyclical' (or sometimes 'activist') if it works against the cyclical tendencies in the economy.[1] That is, countercyclical policies are ones that cool down the economy when it is in an upswing, and stimulate the economy when it is in a downturn.[2]

Keynesian economics advocates the use of automatic and discretionary countercyclical policies to lessen the impact of the business cycle. One example of an automatically countercyclical fiscal policy is progressive taxation. By taxing a larger proportion of income when the economy expands, a progressive tax tends to decrease demand when the economy is booming, thus reining in the boom.

Other schools of economic thought, such as monetarism and new classical macroeconomics, hold that countercyclical policies may be counterproductive or destabilizing, and therefore favor a laissez-faire fiscal policy as a better method for maintaining an overall robust economy.

Meaning in business cycle theory

In business cycle theory, any economic quantity that is negatively correlated with the overall state of the economy is said to be 'countercyclical'.[3][4] That is, any quantity that tends to increase when the overall economy is growing is classified as procyclical. Quantities that tend to increase when the overall economy is slowing down are classified as 'countercyclical'. Unemployment is an example of a countercyclical variable.[5]

Similarly, in finance, an asset that tends to do well while the economy as a whole is doing poorly, is typically referred to as countercyclical. For example, this could be a business, or a financial instrument whose value is derived from a business, that sells an inferior good.

See also

Notes

- ^ Fiscal Policy

- ^ Feldstein, Martin (September 2002). The Role for Discretionary Fiscal Policy in a Low Interest Rate Environment. NBER Working Paper No. 9203. http://www.nber.org/papers/w9203.

- ^ Procyclic Investopedia Retrieved on 27 December 2007

- ^ A. Abel and B. Bernanke (2001), Macroeconomics, 4th edition, Section 8.3.

- ^ A. Abel and B. Bernanke (2001), Macroeconomics, 4th edition, Section 8.3, Summary Table 10.

This article related to macroeconomics is a stub. You can help Wikipedia by expanding it.