- Deadweight loss

-

Deadweight loss created by a binding price ceiling. Producer surplus is necessarily decreased, while consumer surplus may or may not increase; however the decrease in producer surplus must be greater than the increase (if any) in consumer surplus.

Deadweight loss created by a binding price ceiling. Producer surplus is necessarily decreased, while consumer surplus may or may not increase; however the decrease in producer surplus must be greater than the increase (if any) in consumer surplus.

In economics, a deadweight loss (also known as excess burden or allocative inefficiency) is a loss of economic efficiency that can occur when equilibrium for a good or service is not Pareto optimal. In other words, either people who would have more marginal benefit than marginal cost are not buying the product, or people who have more marginal cost than marginal benefit are buying the product.

Causes of deadweight loss can include monopoly pricing (in the case of artificial scarcity), externalities, taxes or subsidies, and binding price ceilings or floors. The term deadweight loss may also be referred to as the "excess burden" of monopoly or taxation.

Contents

Examples

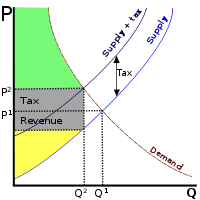

The deadweight loss is the area of the triangle formed by the tax income box, the original supply curve, and the demand curve. This is sometimes called Harberger's triangle.

The deadweight loss is the area of the triangle formed by the tax income box, the original supply curve, and the demand curve. This is sometimes called Harberger's triangle.

For example, consider a market for nails where the cost of each nail is 10 cents and the demand will decrease linearly from a high demand for free nails to zero demand for nails at $1.10. In a perfectly competitive market, producers would have to charge a price of 10 cents and every customer whose marginal benefit exceeds 10 cents would have a nail. However if there is one producer who has a monopoly on the product, then they will charge whatever price will yield the greatest profit. For this market, the producer would charge 60 cents and thus exclude every customer who had less than 60 cents of marginal benefit. The deadweight loss is then the economic benefit forgone by these customers due to the monopoly pricing.

Conversely, deadweight loss can also come from consumers buying a product even if it costs more than it benefits them. To describe this, let's use the same nail market, but instead it will be perfectly competitive, with the government giving a 3 cent subsidy to every nail produced. This 3 cent subsidy will push the market price of each nail down to 7 cents. Some consumers then buy nails even though the benefit to them is less than the real cost of 10 cents. This unneeded expense then creates the deadweight loss: resources are not being used efficiently.

If the price of a glass of beer is $3.00 and the price of a glass of wine is $3.00, a consumer might prefer to drink beer. If the government decides to levy a beer tax of $3.00 per glass, the consumer might prefer to drink wine. The excess burden of taxation is the loss of utility to the consumer for drinking wine instead of beer, since everything else remains unchanged.

Hicks vs. Marshall

An important distinction should be made between Hicksian (per John Hicks) and Marshallian (per Alfred Marshall) deadweight loss. The latter is related to the concept of consumer surplus, such that it can be shown that the Marshallian deadweight loss is zero where demand is perfectly elastic or supply is perfectly inelastic. However, Hicks analyzed the situation through indifference curves and noted that when the Marshallian Demand Curve exhibits perfect inelasticity, the policy or economic situation which caused a distortion in relative prices will have an income effect and that this income effect is a deadweight loss.

In modern economic literature, the most common measure of a taxpayer’s loss of a tax is the equivalent variation. The loss in excess of the tax is the difference between the tax amount and the lump sum tax that the taxpayer would be willing to pay to avoid the tax. However, this is not the only interpretation and Lind & Granqvist (2010) point out that Pigou did not use a lump sum tax as the point of reference when discussing deadweight loss (excess burden).

See also

References

- Case, Karl E. & Fair, Ray C. (1999). Principles of Economics (5th ed.). Prentice-Hall. ISBN 0-13-961905-4.

- Lind, H. & R. Granqvist (2010) A Note on the Concept of Excess Burden. Economic Analysis and Policy 40:63-73.

Microeconomics Major topics Aggregation · Budget · Consumer · Convexity and non-convexity · Cost · Cost-benefit analysis · Distribution · Deadweight loss · Income–consumption curve · Duopoly · Equilibria · Economies of scale · Economies of scope · Elasticity · Exchange · Expected utility · Externality · Firms · General equilibria · Household · Information · Indifference curve · Intertemporal choice · Marginal cost · Market failure · Market structure · Monopoly · Monopsony · Oligopoly · Opportunity cost · Preferences · Prices · Production · Profit · Public goods · Returns to scale · Risk · Scarcity · Shortage · Social choice · Sunk costs · Supply & demand · Surplus · Uncertainty · Utility · WelfareRelated Behavioral · Business · Computational · Decision theory · Econometrics · Experimental · Game theory · Industrial organization · Mathematical economics · Microfoundations of Macroeconomics · Managerial · Operations research · OptimizationCategories:- Welfare economics

- Economics terminology

Wikimedia Foundation. 2010.