- Short (finance)

-

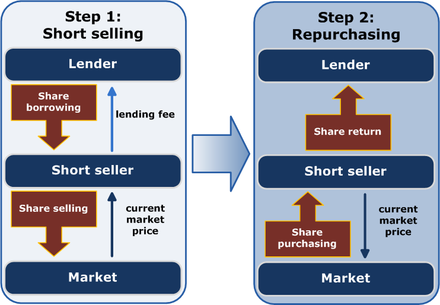

Schematic representation of short selling in two steps. The short seller borrows shares and immediately sells them. He then waits, hoping for the stock price to decrease, when the seller can profit by purchasing the shares to return to the lender.

Schematic representation of short selling in two steps. The short seller borrows shares and immediately sells them. He then waits, hoping for the stock price to decrease, when the seller can profit by purchasing the shares to return to the lender.

In finance, short selling (also known as shorting or going short) is the practice of selling assets, usually securities, that have been borrowed from a third party (usually a broker) with the intention of buying identical assets back at a later date to return to that third party. The short seller hopes to profit from a decline in the price of the assets between the sale and the repurchase, as the seller will pay less to buy the assets than it received on selling them. The short seller will incur a loss if the price of the assets rises (as it will have to buy them at a higher price than it sold them), and there is no theoretical limit to the loss that can be incurred by a short seller. Other costs of shorting may include a fee for borrowing the assets and payment of any dividends paid on the borrowed assets. "Shorting" and "going short" also refer to entering into any derivative or other contract under which the investor similarly profits from a fall in the value of an asset. Mathematically, short selling is equivalent to buying a negative amount of the assets.

Short selling is almost always conducted with assets traded in public securities, commodities or currency markets, as on such markets the amount being made or lost can be monitored in real time and it is generally possible to buy back the borrowed assets whenever required. Because such assets are fungible, any assets of the same type bought on those markets can be used to return to the lender.

Going short can be contrasted with the more conventional practice of "going long", whereby an investor profits from any increase in the price of the asset.

Contents

Concept

Finance Government spending:

Government final consumption expenditure

Warrant of payment

Government operations

Redistribution of wealth

Transfer payment

Government revenue:

Taxation

Deficit spending

Government budget

Government budget deficit

Government debt

Non-tax revenueProfessional certification in financial services

Accounting scandalsTo profit from a decrease in the price of a security, a short seller can borrow the security and sell it expecting that it will be cheaper to repurchase in the future. When the seller decides that the time is right (or when the lender recalls the securities), the seller buys equivalent securities and returns them to the lender. The process relies on the fact that the securities (or the other assets being sold short) are fungible; the term "borrowing" is therefore used in the sense of borrowing $10, where a different $10 note can be returned to the lender (as opposed to borrowing a car, where the same car must be returned).

A short seller typically borrows through a broker, who is usually holding the securities for another investor who owns the securities; the broker himself seldom purchases the securities to lend to the short seller.[1] The lender does not lose the right to sell the securities while they have been lent, as the broker will usually hold a large pool of such securities for a number of investors which, as such securities are fungible, can instead be transferred to any buyer. In most market conditions there is a ready supply of securities to be borrowed, held by pension funds, mutual funds and other investors.

The act of buying back the securities that were sold short is called "covering the short" or "covering the position". A short position can be covered at any time before the securities are due to be returned. Once the position is covered, the short seller will not be affected by any subsequent rises or falls in the price of the securities, as he already holds the securities required to repay the lender.

The terms shorting and going short are also used as blanket terms for tactics that allow an investor to gain from the decline in price of a security. Such tactics are generally based on a derivative contract, such as an option, a future or a similar synthetic position. For example, a put option consists of the right to sell an asset at a given strike price; the owner of the option therefore benefits when the market price of the asset falls below that price, as he can buy the asset at the lower price and sell it under the option at the strike price. Similarly, a short position in a futures contract means the holder of the position has an obligation to sell the underlying asset later at a given price; if the price falls below the given price, the person with the short position can buy the asset at the lower price and sell it under the future at the higher price.

Worked examples

Profitable trade

Shares in C & Company currently trade at $10 per share.

- A short seller borrows 100 shares of C & Company and immediately sells them for a total of $1,000.

- Subsequently, the price of the shares falls to $8 per share.

- Short seller now buys 100 shares of C & Company for $800.

- Short seller returns the shares to the lender, who must accept the return of the same number of shares as was lent despite the fact that the market value of the shares has decreased.

- Short seller retains as profit the $200 difference (minus borrowing fees) between the price at which he sold the shares he borrowed and the lower price at which he was able to purchase the shares he returned.

Loss-making trade

Shares in C & Company currently trade at $10 per share.

- A short seller borrows 100 shares of C & Company and immediately sells them for a total of $1,000.

- Subsequently the price of the shares rises to $25.

- Short seller is required to return the shares, and to meet the obligation is compelled to buy 100 shares of C & Company for $2,500.

- Short seller returns the shares to the lender who accepts the return of the same number of shares as was lent.

- Short seller incurs as a loss the $1,500 difference between the price at which he sold the shares he borrowed and the higher price at which he had to purchase the shares he returned (plus borrowing fees).

Comparison with long positions

Short selling is the opposite of "going long". A short seller takes a negative, or "bearish", stance, believing that the price of a security will fall. Investors who employ short selling often use it to allow them to profit on trading in securities which they believe are overvalued, just as traditional long investors attempt to profit on securities which are undervalued by buying them.

Because a short position is the opposite of a long position, many features of the position are reversed in comparison. In particular, the profit (rather than the loss) is limited to the value of the security, but the loss (rather than the profit) is theoretically unlimited. In practice, as the price of a security rises the short seller will receive a margin call from the broker, demanding that the short seller either cover his short position (by purchasing the security) or provide additional cash in order to meet the margin requirement for the security, which effectively places a limit on the amount that can be lost.

History

Some hold that the practice was invented in 1609 by Dutch merchant Isaac Le Maire, a sizeable shareholder of the Vereenigde Oostindische Compagnie (VOC).[2]

Short selling has been a target of ire ever since. In the eighteenth century, England banned it outright.[3] The London banking house of Neal, James, Fordyce and Down collapsed in June 1772, precipitating a major crisis which included the collapse of almost every private bank in Scotland, and a liquidity crisis in the two major banking centres of the world, London and Amsterdam. The bank had been speculating by shorting East India Company stock on a massive scale, and apparently using customer deposits to cover losses. It was perceived as having a magnifying effect in the violent downturn in the Dutch tulip market in the eighteenth century. In another well-referenced example, George Soros became notorious for "breaking the Bank of England" on Black Wednesday of 1992, when he sold short more than $10 billion worth of pounds sterling.

The term "short" was in use from at least the mid-nineteenth century. It is commonly understood that "short" is used because the short-seller is in a deficit position with his brokerage house. Jacob Little was known as The Great Bear of Wall Street who began shorting stocks in the United States in 1822.[4]

Short sellers were blamed for the Wall Street Crash of 1929.[5] Regulations governing short selling were implemented in the United States in 1929 and in 1940.[citation needed] Political fallout from the 1929 crash led Congress to enact a law banning short sellers from selling shares during a downtick; this was known as the uptick rule, and this was in effect until July 3, 2007 when it was removed by the SEC (SEC Release No. 34-55970).[6] President Herbert Hoover condemned short sellers and even J. Edgar Hoover said he would investigate short sellers for their role in prolonging the Depression. Legislation introduced in 1940 banned mutual funds from short selling (this law was lifted in 1997).[citation needed] A few years later, in 1949, Alfred Winslow Jones founded a fund (that was unregulated) that bought stocks while selling other stocks short, hence hedging some of the market risk, and the hedge fund was born.[7]

Some typical examples of mass short-selling activity are during "bubbles", such as the Dot-com bubble.[citation needed] At such times, short-sellers typically hope to profit from a market correction. Food and Drug Administration (FDA) announcements approving a drug often cause the market to react irrationally due to media attention; short sellers use the opportunity to sell into the buying frenzy and wait for the exaggerated reaction to subside before covering their position.[citation needed] Negative news, such as litigation against a company, may also entice professional traders to sell the stock short.

During the Dot-com bubble, shorting a start-up company could backfire since it could be taken over at a price higher than the price at which speculators shorted. Short-sellers were forced to cover their positions at acquisition prices, while in many cases the firm often overpaid for the start-up.

Short selling restrictions in 2008

In September 2008 short selling, exacerbated by naked short selling,[8] was seen as a contributing factor to undesirable market volatility, and was subsequently prohibited by the U.S. Securities and Exchange Commission (SEC) for 799 financial companies for three weeks in an effort to stabilize those companies.[9] At the same time the U.K. Financial Services Authority (FSA) prohibited short selling for 32 financial companies.[10] On September 22, Australia enacted even more extensive measures with a total ban of short selling.[11] Also on September 22, the Spanish market regulator, CNMV, required investors to notify it of any short positions in financial institutions, if they exceed 0.25% of a company's share capital, and it also restricted naked shorting.[12]

In an interview with the Washington Post in late December 2008, U.S. Securities and Exchange Commission Chairman Christopher Cox said that the decision to impose a three-week ban on short selling of financial company stocks was taken reluctantly, but that the view at the time, from Treasury Secretary Henry M. Paulson and Federal Reserve chairman Ben S. Bernanke, was that "if we did not act, and act at that instant, these financial institutions could fail as a result and there would be nothing left to save." Later he changed his mind and thought the ban unproductive.[13] In a December 2008 interview with Reuters, he explained that the SEC's Office of Economic Analysis was still evaluating data from the temporary ban, and that preliminary findings point to several unintended market consequences and side effects. "While the actual effects of this temporary action will not be fully understood for many more months, if not years," he said, "knowing what we know now, I believe on balance the Commission would not do it again.”[14]

Short selling restrictions in European economic crisis

In June 2010, due to the economical crisis Germany permanently banned naked short selling.[15]

In August 2011, France, Italy, Spain, Belgium and South Korea banned all short selling in their financial stocks.[16]

Mechanism

see Securities lending. Short selling stock consists of the following:

- The investor instructs the broker to sell the shares and the proceeds are credited to his broker's account at the firm upon which the firm can earn interest. Generally, the short seller does not earn interest on the short proceeds and cannot use or encumber the proceeds for another transaction.[17]

- Upon completion of the sale, the investor has 3 days (in the US) to borrow the shares. If required by law, the investor first ensures that cash or equity is on deposit with his brokerage firm as collateral for the initial short margin requirement. Some short sellers, mainly firms and hedge funds, participate in the practice of naked short selling, where the shorted shares are not borrowed or delivered.

- The investor may close the position by buying back the shares (called covering). If the price has dropped, he makes a profit. If the stock advanced, he takes a loss.

- Finally, the investor may return the shares to the lender or stay short indefinitely.

- At any time, the lender may call for the return of his shares e.g. because he wants to sell them. The borrower must buy shares on the market and return them to the lender (or he must borrow the shares from elsewhere). When the broker completes this transaction automatically, it is called a 'buy-in'.

Shorting stock in the U.S.

In the U.S., in order to sell stocks short, the seller must arrange for a broker-dealer to confirm that it is able to make delivery of the shorted securities. This is referred to as a "locate.” Brokers have a variety of means to borrow stocks in order to facilitate locates and make good delivery of the shorted security.

The vast majority of stocks borrowed by U.S. brokers come from loans made by the leading custody banks and fund management companies (see list below). Institutions often lend out their shares in order to earn a little extra money on their investments. These institutional loans are usually arranged by the custodian who holds the securities for the institution. In an institutional stock loan, the borrower puts up cash collateral, typically 102% of the value of the stock. The cash collateral is then invested by the lender, who often rebates part of the interest to the borrower. The interest that is kept by the lender is the compensation to the lender for the stock loan.

Brokerage firms can also borrow stocks from the accounts of their own customers. Typical margin account agreements give brokerage firms the right to borrow customer shares without notifying the customer. In general, brokerage accounts are only allowed to lend shares from accounts for which customers have "debit balances", meaning they have borrowed from the account. SEC Rule 15c3-3 imposes such severe restrictions on the lending of shares from cash accounts or excess margin (fully paid for) shares from margin accounts that most brokerage firms do not bother except in rare circumstances. (These restrictions include that the broker must have the express permission of the customer and provide collateral or a letter of credit.)

Most brokers will allow retail customers to borrow shares to short a stock only if one of their own customers has purchased the stock on margin. Brokers will go through the "locate" process outside their own firm to obtain borrowed shares from other brokers only for their large institutional customers.

Stock exchanges such as the NYSE or the NASDAQ typically report the "short interest" of a stock, which gives the number of shares that have been legally sold short as a percent of the total float. Alternatively, these can also be expressed as the short interest ratio, which is the number of shares legally sold short as a multiple of the average daily volume. These can be useful tools to spot trends in stock price movements but in order to be reliable, investors must also ascertain the number of shares brought into existence by naked shorters. Investors are cautioned to remember that for every share that has been shorted (owned by a new owner), a 'shadow owner' exists (i.e. the original owner) who also is part of the universe of owners of that stock, i.e. Despite not having any voting rights, he has not relinquished his interest and some rights in that stock.

Securities lending

Main article: Securities lendingWhen a security is sold, the seller is contractually obligated to deliver it to the buyer. If a seller sells a security short without owning it first, the seller needs to borrow the security from a third party to fulfill its obligation. Otherwise, the seller will "fail to deliver," the transaction will not settle, and the seller may be subject to a claim from its counterparty. Certain large holders of securities, such as a custodian or investment management firm, often lend out these securities to gain extra income, a process known as securities lending. The lender receives a fee for this service. Similarly, retail investors can sometimes make an extra fee when their broker wants to borrow their securities. This is only possible when the investor has full title of the security, so it cannot be used as collateral for margin buying.

Sources of short interest data

Time delayed short interest data (for legally shorted shares) is available in a number of countries, including the US, the UK, Hong Kong, and Spain. The amount of stocks being shorted on a global basis has increased in recent years for various structural reasons (e.g. the growth of 130/30 type strategies, short or bear ETFs). The data is typically delayed; for example, the NASDAQ requires its broker-dealer member firms to report data on the 15th of each month, and then publishes a compilation eight days later.[18]

Some market data providers (like Data Explorers and SunGard Financial Systems[19]) believe that stock lending data provides a good proxy for short interest levels (excluding any naked short interest). SunGard provides daily data on short interest by tracking the proxy variables based on borrowing and lending data which it collects.[20]

Short selling terms

Days to Cover (DTC) is a numerical term that describes the relationship between the amount of shares in a given equity that have been legally short sold and the number of days of typical trading that it would require to 'cover' all legal short positions outstanding. For example, if there are ten million shares of XYZ Inc. that are currently legally short sold and the average daily volume of XYZ shares traded each day is one million, it would require ten days of trading for all legal short positions to be covered (10 million / 1 million).

Short Interest is a numerical term that relates the number of shares in a given equity that have been legally shorted divided by the total shares outstanding for the company, usually expressed as a percent. For example, if there are ten million shares of XYZ Inc. that are currently legally short sold, and the total number of shares issued by the company is one hundred million, the Short Interest is 10% (10 million / 100 million). If however, shares are being created through naked short selling, "fails" data must be accessed to assess accurately the true level of short interest.

Major lenders

- Merrill Lynch (New Jersey)

- State Street Corporation (Boston)

- JP Morgan Chase (New York)

- Northern Trust (Chicago)

- Fortis (Amsterdam, now defunct)

- ABN AMRO (Amsterdam, Netherlands, formerly Fortis)

- Citibank (New York)

- Bank of New York Mellon Corporation (New York)

- UBS AG (Zurich, Switzerland)

- Barclays (London, England)

Naked short selling

Main article: Naked short sellingA naked short sale occurs when a security is sold short without borrowing the security within a set time, 3 days (T+3) in the US. This means that the buyer of such a short is buying the short-seller's promise to deliver a share, rather than buying the share itself. The short-seller's promise is known as a hypothecated share.

When the holder of the underlying stock receives a dividend, the holder of the hypothecated share would receive an equal dividend from the short seller.

Naked shorting has been made illegal except where allowed under limited circumstances by market makers. It is detected by the Depository Trust & Clearing Corporation (in the US) as a "failure to deliver" or simply "fail.” While many fails are settled in a short time, some have been allowed to linger in the system.

In the US, arranging to borrow a security before a short sale is called a locate. In 2005, to prevent widespread failure to deliver securities, the U.S. Securities and Exchange Commission (SEC) put in place Regulation SHO, intended to prevent investors from selling some stocks short before doing a locate. Requirements that are more stringent were put in place in September 2008, ostensibly to prevent the practice from exacerbating market declines. The rules were made permanent in 2009.

Fees

When a broker facilitates the delivery of a client's short sale, the client is charged a fee for this service, usually a standard commission similar to that of purchasing a similar security.

If the short position begins to move against the holder of the short position (i.e., the price of the security begins to rise), money will be removed from the holder's cash balance and moved to his or her margin balance. If short shares continue to rise in price, and the holder does not have sufficient funds in the cash account to cover the position, the holder will begin to borrow on margin for this purpose, thereby accruing margin interest charges. These are computed and charged just as for any other margin debit.

When a security's ex-dividend date passes, the dividend is deducted from the shortholder's account and paid to the person from whom the stock was borrowed.

For some brokers, the short seller may not earn interest on the proceeds of the short sale or use it to reduce outstanding margin debt. These brokers may not pass this benefit on to the retail client unless the client is very large. This means an individual short-selling $1000 of stock will lose the interest to be earned on the $1000 cash balance in his or her account.

Dividends and voting rights

Where shares have been shorted and the company which issues the shares distributes a dividend, the question arises as to who receives the dividend. The new buyer of the shares, who is the "holder of record" and holds the shares outright, will receive the dividend from the company. However, the lender, who may hold its shares in a margin account with a prime broker and is unlikely to be aware that these particular shares are being lent out for shorting, also expects to receive a dividend. The short seller will therefore pay to the lender an amount equal to the dividend in order to compensate, though as this payment does not come from the company it is not technically a dividend as such. The short seller is therefore said to be "short the dividend".

A similar issue comes up with the voting rights attached to the shorted shares. Unlike a dividend, voting rights cannot legally be synthesized and so the buyer of the shorted share, as the holder of record, controls the voting rights. The owner of a margin account from which the shares were lent will have agreed in advance to relinquish voting rights to shares during the period of any short sale.[21] As noted earlier, victims of Naked Shorting attacks sometimes report that the number of votes cast is greater than the number of shares issued by the company.[22]

Markets

Futures and options contracts

When trading futures contracts, being 'short' means having the legal obligation to deliver something at the expiration of the contract, although the holder of the short position may alternately buy back the contract prior to expiration instead of making delivery. Short futures transactions are often used by producers of a commodity to fix the future price of goods they have not yet produced. Shorting a futures contract is sometimes also used by those holding the underlying asset (i.e. those with a long position) as a temporary hedge against price declines. Shorting futures may also be used for speculative trades, in which case the investor is looking to profit from any decline in the price of the futures contract prior to expiration.

An investor can also purchase a put option, giving that investor the right (but not the obligation) to sell the underlying asset (such as shares of stock) at a fixed price. In the event of a market decline, the option holder may exercise these put options, obliging the counterparty to buy the underlying asset at the agreed upon (or "strike") price, which would then be higher than the current quoted spot price of the asset.

Currency

Selling short on the currency markets is different from selling short on the stock markets. Currencies are traded in pairs, each currency being priced in terms of another. In this way, selling short on the currency markets is identical to going long on stocks.

Novice traders or stock traders can be confused by the failure to recognize and understand this point: a contract is always long in terms of one medium and short another.

When the exchange rate has changed, the trader buys the first currency again; this time he gets more of it, and pays back the loan. Since he got more money than he had borrowed initially, he makes money. Of course, the reverse can also occur.

An example of this is as follows: Let us say a trader wants to trade with the US dollar and the Indian rupee currencies. Assume that the current market rate is USD 1 to Rs.50 and the trader borrows Rs.100. With this, he buys USD 2. If the next day, the conversion rate becomes USD 1 to Rs.51, then the trader sells his USD 2 and gets Rs.102. He returns Rs.100 and keeps the Rs.2 profit (minus fees).

One may also take a short position in a currency using futures or options; the preceding method is used to bet on the spot price, which is more directly analogous to selling a stock short.

Risks

Note: this section does not apply to currency markets.

Short selling is sometimes referred to as a "negative income investment strategy" because there is no potential for dividend income or interest income. Stock is held only long enough to be sold pursuant to the contract, and one's return is therefore limited to short term capital gains, which are taxed as ordinary income. For this reason, buying shares (called "going long") has a very different risk profile from selling short. Furthermore, a "long's" losses are limited because the price can only go down to zero, but gains are not, as there is no limit, in theory, on how high the price can go. On the other hand, the short seller's possible gains are limited to the original price of the stock, which can only go down to zero, whereas the loss potential, again in theory, has no limit. For this reason, short selling probably is most often used as a hedge strategy to manage the risks of long investments.

Many short sellers place a "stop order" with their stockbroker after selling a stock short. This is an order to the brokerage to cover the position if the price of the stock should rise to a certain level, in order to limit the loss and avoid the problem of unlimited liability described above. In some cases, if the stock's price skyrockets, the stockbroker may decide to cover the short seller's position immediately and without his consent, in order to guarantee that the short seller will be able to make good on his debt of shares.

Short sellers must be aware of the potential for a short squeeze. When the price of a stock rises significantly, some people who are shorting the stock will cover their positions to limit their losses (this may occur in an automated way if the short sellers had stop-loss orders in place with their brokers); others may be forced to close their position to meet a margin call; others may be forced to cover, subject to the terms under which they borrowed the stock, if the person who lent the stock wishes to sell and take a profit. Since covering their positions involves buying shares, the short squeeze causes an ever further rise in the stock's price, which in turn may trigger additional covering. Because of this, most short sellers restrict their activities to heavily traded stocks, and they keep an eye on the "short interest" levels of their short investments. Short interest is defined as the total number of shares that have been legally sold short, but not covered. A short squeeze can be deliberately induced. This can happen when large investors (such as companies or wealthy individuals) notice significant short positions, and buy many shares, with the intent of selling the position at a profit to the short sellers who will be panicked by the initial uptick or who are forced to cover their short positions in order to avoid margin calls.

Another risk is that a given stock may become "hard to borrow." As defined by the SEC and based on lack of availability, a broker may charge a hard to borrow fee daily, without notice, for any day that the SEC declares a share is hard to borrow. Additionally, a broker may be required to cover a short seller's position at any time ("buy in"). The short seller receives a warning from the broker that he is "failing to deliver" stock, which will lead to the buy-in.[23]

Because short sellers must deliver the shorted securities to their broker eventually, and will need money to buy them, there is a credit risk for the broker. The penalties for failure to deliver on a short selling contract inspired financier Daniel Drew to warn: "He who sells what isn't his'n, Must buy it back or go to pris'n." To manage its own risk, the broker requires the short seller to keep a margin account, and charges interest of between 2% and 8% depending on the amounts involved.[24]

In 2011, the eruption of the massive China stock frauds on North American equity markets brought a related risk to light for the short seller. The efforts of research-oriented short sellers to expose these frauds eventually prompted NASDAQ, NYSE and other exchanges to impose sudden, lengthy trading halts that froze the values of shorted stocks at artificially high values. Reportedly in some instances, brokers charged short sellers excessively large amounts of interest based on these high values as the shorts were forced to continue their borrowings at least until the halts were lifted.[25]

Short sellers tend to temper overvaluation by selling into exuberance. Likewise, short sellers are said to provide price support by buying when negative sentiment is exacerbated after a significant price decline. Short selling can have negative implications if it causes a premature or unjustified share price collapse when the fear of cancellation due to bankruptcy becomes contagious.[26]

Strategies

Hedging

Further information: Hedge (finance)Hedging often represents a means of minimizing the risk from a more complex set of transactions. Examples of this are:

- A farmer who has just planted his wheat wants to lock in the price at which he can sell after the harvest. He would take a short position in wheat futures.

- A market maker in corporate bonds is constantly trading bonds when clients want to buy or sell. This can create substantial bond positions. The largest risk is that interest rates overall move. The trader can hedge this risk by selling government bonds short against his long positions in corporate bonds. In this way, the risk that remains is credit risk of the corporate bonds.

- an options trader may short shares in order to remain delta neutral so that he is not exposed to risk from price movements in the stocks that underlie his options

Arbitrage

Further information: ArbitrageA short seller may be trying to benefit from market inefficiencies arising from the mispricing of certain products. Examples of this are

- An arbitrageur who buys long futures contracts on a US Treasury security, and sells short the underlying US Treasury security.

Against the box

One variant of selling short involves a long position. "Selling short against the box" consists of holding a long position on which the shares have already risen, whereupon one then enters a short sell order for an equal amount of shares. The term box alludes to the days when a safe deposit box was used to store (long) shares. The purpose of this technique is to lock in paper profits on the long position without having to sell that position (and possibly incur taxes if said position has appreciated). Once the short position has been entered, it serves to balance the long position taken earlier. Thus, from that point in time, the profit is locked in (less brokerage fees and short financing costs), regardless of further fluctuations in the underlying share price. For example, one can ensure a profit in this way, while delaying sale until the subsequent tax year.

U.S. investors considering entering into a "short against the box" transaction should be aware of the tax consequences of this transaction. Unless certain conditions are met, the IRS deems a "short against the box" position to be a "constructive sale" of the long position, which is a taxable event. These conditions include a requirement that the short position be closed out within 30 days of the end of the year and that the investor must hold their long position, without entering into any hedging strategies, for a minimum of 60 days after the short position has been closed.[27]

The regulatory response

In the US, Regulation SHO was the SEC's first update to short selling restrictions since 1938. It established "locate" and "close-out" requirements[clarification needed] for broker-dealers, in an effort to curb naked short selling. Compliance with the regulation began on January 3, 2005.[28]

In the US, initial public offerings (IPOs) cannot be sold short for a month after they start trading. This mechanism is in place to ensure a degree of price stability during a company's initial trading period. However, some brokerages that specialize in penny stocks (referred to colloquially as bucket shops) have used the lack of short selling during this month to pump and dump thinly traded IPOs. Canada and other countries do allow selling IPOs (including U.S. IPOs) short.

In the UK, the Financial Services Authority had a moratorium on short selling 29 leading financial stocks, effective from 2300 GMT, 19 September 2008 until 16 January 2009.[29]

After the ban was lifted, John McFall, chairman of the Treasury Select Committee, House of Commons, made clear in public statements and a letter to the FSA that he believed it ought to be extended.

In the US, a similar response was made by the Securities and Exchange Commission with a ban on short selling on 799 financial stocks from 19 September 2008 until 2 October 2008. Greater penalties for naked shorting, by mandating delivery of stocks at clearing time, were also introduced. Some state governors have been urging state pension bodies to refrain from lending stock for shorting purposes.[30]

Soon thereafter, between 19 and 21 September 2008, Australia temporarily banned short selling,[31] and later placed an indefinite ban on naked short selling.[32] The ban on short selling was further extended for another 28 days on 21 October 2008.[33] Germany, Ireland, Switzerland and Canada banned short selling leading financial stocks,[34] and France, the Netherlands and Belgium banned naked short selling leading financial stocks.[35]

By contrast, Chinese regulators have responded by allowing short selling, along with a package of other market reforms.[36]

An assessment of the effect of a ban on short-selling that was enacted in many countries in the fall of 2008 showed that it had only "little impact" on the movements of stocks, with stock prices moving in the same way as they would have moved anyhow, but the ban reduced volume and liquidity.[37] By December, countries in Europe were considering to remove the ban, while the ban in the US was already lifted in October 2008. The SEC proposed new restrictions on short selling in April 2009.

Views of short selling

Advocates of short selling argue that the practice is an essential part of the price discovery mechanism.[38] Financial researchers at Duke University said in a study that short interest is an indicator of poor future stock performance (the self-fulfilling aspect) and that short sellers exploit market mistakes about firms' fundamentals.[39]

Such noted investors as Seth Klarman and Warren Buffett have said that short sellers help the market. Klarman argued that short sellers are a useful counterweight to the widespread bullishness on Wall Street,[40] while Buffett believes that short sellers are useful in uncovering fraudulent accounting and other problems at companies.[41]

Shortseller James Chanos received widespread publicity when he was an early critic of the accounting practices of Enron Corp.[42] Chanos responds to critics of short-selling by pointing to the critical role they played in identifying problems at Enron, Boston Market and other "financial disasters" over the years.[43] In 2011, research oriented short sellers were widely acknowledged for exposing the China Stock Frauds.[44]

Commentator Jim Cramer has expressed concern about short selling and started a petition calling for the reintroduction of the uptick rule.[45] Books like Don't Blame the Shorts by Robert Sloan and Fubarnomics by Robert E. Wright suggest Cramer exaggerated the costs of short selling and underestimated the benefits, which may include the ex ante identification of asset bubbles.

Individual short sellers have been subject to criticism and even litigation. Manuel P. Asensio, for example, engaged in a lengthy legal battle with the pharmaceutical manufacturer Hemispherx Biopharma.[46]

Several scientific results on the effectiveness of short selling bans indicate that short selling bans do not contribute to more moderate market dynamics.[47][48][49][50]

See also

- Inverse exchange-traded fund

- Joseph Parnes

- Long (finance)

- James Chanos

- Magnetar Capital

- Manuel P. Asensio

- Repurchase agreement

- Securities lending

- Short ratio

- Socially responsible investing

- Speculation

- Straddle

- Uptick rule

- Anthony Elgindy

References

- ^ Understanding Short Selling - A Primer

- ^ NRC Handelsblad - Naked short selling is an old-Dutch trick (in Dutch only)

- ^ (Charlie Fell)

- ^ [1]

- ^ "Short sellers have been the villain for 400 years". Reuters. 2008-09-26. http://www.reuters.com/article/reutersEdge/idUSTRE48P7CS20080926?PageNumber=2&virtualBrandChannel=0&sp=true. Retrieved 2008-09-28.

- ^ SEC Release No. 34-55970

- ^ New York Magazine - The Creation of the Hedge Fund

- ^ "EMERGENCY ORDER PURSUANT TO SECTION 12(k)(2) OF THE SECURITIES EXCHANGE ACT OF 1934 TAKING TEMPORARY ACTION TO RESPOND TO MARKET DEVELOPMENTS. Release NO. 34-58592". September 18, 2008. http://www.sec.gov/rules/other/2008/34-58592.pdf

- ^ "SEC Halts Short Selling of Financial Stocks to Protect Investors and Markets". . 2008-09-19. http://www.sec.gov/news/press/2008/2008-211.htm. Retrieved 2008-09-19.

- ^ "FSA statement on short positions in financial stocks". FSA. 2008-09-18. http://www.fsa.gov.uk/pages/Library/Communication/PR/2008/102.shtml. Retrieved 2008-09-19.

- ^ "Australian short selling ban goes further than other bourses". NBR. 2008-09-22. http://www.nbr.co.nz/article/australian-short-selling-ban-goes-further-other-bourses-35494. Retrieved 2008-09-22.

- ^ "La CNMV también estrecha el cerco a las posiciones bajistas". Expansión. 2008-09-22. http://www.expansion.com/2008/09/22/inversion/1167625.html. Retrieved 2008-09-22.

- ^ Paley, Amit R.; Hilzenrath, David S. (2008-12-24). "SEC Chair Defends His Restraint During Financial Crisis". The Washington Post. http://www.washingtonpost.com/wp-dyn/content/article/2008/12/23/AR2008122302765.html?sid=ST2008122302866&s_pos=. Retrieved 2010-05-23.

- ^ "SEC chief has regrets over short-selling ban". Reuters. 2008-12-31. http://www.reuters.com/article/ousivMolt/idUSTRE4BU3FL20081231.

- ^ Reuters (May 28, 2010). "Germany to permanently ban some short selling: Bafin'". Reuters. http://www.reuters.com/article/idUSTRE64R2PF20100528.

- ^ Geert de Clercq, Paul Day (11 August 2011), "WRAPUP 7-Europe curbs short-selling as credit markets swoon", Reuters, http://www.reuters.com/article/2011/08/12/europe-banks-idUSLDE77A05U20110812

- ^ Federal Reserve Board. Regulation T § 220.12

- ^ NASDAQ. About the Short Interest Page.

- ^ SunGard's ShortSide.com discusses the product.

- ^ SunGard. SunGard Launches Borrow Indices; First Proxy for Measuring Short Interest on a Daily Basis. Business Wire.

- ^ "What happens to the voting rights on shares when the shares are used in a short sale transaction?". Investopedia. http://www.investopedia.com/ask/answers/05/shortsalevotingrights.asp. Retrieved 4 December 2008.

- ^ Over-voting at Taser in 2005

- ^ http://www.thestreet.com/story/862233/1/knowing-the-rules-of-the-shorting-game.html

- ^ "margin account rates schedule". ScotTrade. 2011-6-18. http://www.scottrade.com/online-brokerage/interest-margin-rates.html.

- ^ "Even Short-Sellers Burned by Chinese Shares". Barrons. 2011-6-18. http://online.barrons.com/article/SB50001424053111904113704576383892664177456.html?ru=yahoo&mod=yahoobarrons.

- ^ The Theory and Practice of Short Selling, Chapter 9, Conclusions and Implications for Investors by Frank J. Fabozzi, Editor

- ^ United States IRS Publication 550 Investment Income and Expenses

- ^ U.S. SEC (April 11, 2005). "Division of Market Regulation: Key Points about Regulation SHO". http://www.sec.gov/spotlight/keyregshoissues.htm.

- ^ BBC (2008-09-18). "FSA clamps down on short-selling". BBC News. http://news.bbc.co.uk/1/hi/business/7624012.stm. Retrieved 2010-01-04.

- ^ Bloomberg (2008-09-19). "Short Sellers under Fire in U.S., U.K. After AIG Fall". http://www.bloomberg.com/apps/news?pid=20601087&sid=aTHLqfgpnFYw&refer=home.

- ^ . http://www.theaustralian.news.com.au/story/0,25197,24432750-5014000,00.html.[dead link]

- ^ "ASX ban on short selling is indefinite". The Sydney Morning Herald. 2008-10-03. http://news.smh.com.au/business/asx-ban-on-short-selling-is-indefinite-20081003-4t16.html.

- ^ http://www.asic.gov.au/asic/asic.nsf/byheadline/08-210+ASIC+extends+ban+on+covered+short+selling?openDocument

- ^ McDonald, Sarah (22 September 2008). "Australian short selling ban goes further than other bourses". National Business Review. http://www.nbr.co.nz/article/australian-short-selling-ban-goes-further-other-bourses-35494. Retrieved 9 November 2011.

- ^ Ram, Vidya (2008-09-22). "Europe Spooked By Revenge Of The Commodities". Forbes. http://www.forbes.com/markets/2008/09/22/briefing-europe-update-markets-equity-cx_vr_0922markets12.html.

- ^ Shen, Samuel (2008-10-05). "UPDATE 2-China to launch stocks margin trade, short sales". Reuters. http://www.reuters.com/article/rbssFinancialServicesAndRealEstateNews/idUSSHA10179120081005.

- ^ Oakley D (2008-12-18). "Short-selling ban has minimal effect.". Financial Times: 27.

- ^ Short Sale Constraints And Stock Returns by C.M Jones and O.A. Lamont

- ^ Do Short Sellers Convey Information About Changes in Fundamentals or Risk?

- ^ Margin of safety (1991), by Seth Klarman. ISBN 0-88730-510-5

- ^ 2006 Berkshire Hathaway Annual Meeting Q&A with Warren Buffett

- ^ Peterson, Jim (2002-07-06). "Balance Sheet : The silly season isn't over yet". The New York Times. http://www.nytimes.com/2002/07/06/your-money/06iht-maccount06_ed3_.html. Retrieved 2009-08-09.[dead link]

- ^ Contrarian Investor Sees Economic Crash in China

- ^ B. Alpert "Even Short Sellers Burned by Chinese Shares" (Barrons 20110618)

- ^ http://www.thestreet.com/petition

- ^ Nelson, Brett (2001-11-26). "Short Story". Forbes. http://members.forbes.com/forbes/2001/1126/216.html. Retrieved 2009-08-09.

- ^ Marsh I and Niemer N (2008) "The impact of short sales restrictions". Technical report, commissioned and funded by the International Securities Lending Association (ISLA) the Alternative Investment Management Association (AIMA) and London Investment Banking Association (LIBA).

- ^ Lobanova O, Hamid S. S. and Prakash A. J. (2010) "The impact of short-sale restrictions on volatility, liquidity, and market e�ciency: the evidence from the short-sale ban in the u.s." Technical report, Florida International University - Department of Finance.

- ^ Beber A. and Pagano M. (2009) "Short-selling bans around the world: Evidence from the 2007-09 crisis". CSEF Working Papers 241, Centre for Studies in Economics and Finance (CSEF), University of Naples, Italy.

- ^ Kerbl S (2010) "Regulatory Medicine Against Financial Market Instability: What Helps And What Hurts?" arXiv.org. doi:1011.6284

- Sloan, Robert. Don't Blame the Shorts: Why Short Sellers Are Always Blamed for Market Crashes and Why History Is Repeating Itself, (New York: McGraw-Hill Professional, 2009). ISBN 978-0-07-163686-5

- Wright, Robert E. Fubarnomics: A Lighthearted, Serious Look at America's Economic Ills, (Buffalo, N.Y.: Prometheus, 2010). ISBN 978-1-61614-191-2

External links and sources

- Barron's on Off Wall Street Consulting Group, July 31, 2010

- Porsche VW Shortselling Scandal

- "Short-Selling Bans Dampen 130/30 Strategies Worldwide," Global Investment Technology, Sept. 29, 2008

- Short Selling Introduction

- Short Interest: What it tells us

- SEC Discussion of Naked Short Selling

- '"Financial Interest Disclosures Can Protect Markets from 'Short & Distort' Manipulators", Alex J. Pollock, June 6, 2006, Washington Legal Foundation

- Coverage of controversial short-selling 'conspiracy' lawsuits by tobacco litigation specialists in US: Short Tempers, Risk Magazine (2006), Navroz Patel

- In pursuit of the naked short, Journal of Law and Business, New York University, Spring 2009

Categories:- Short selling

- Financial markets

- Finance

- Financial regulation

Wikimedia Foundation. 2010.