- Net present value

-

In finance, the net present value (NPV) or net present worth (NPW)[1] of a time series of cash flows, both incoming and outgoing, is defined as the sum of the present values (PVs) of the individual cash flows of the same entity. In the case when all future cash flows are incoming (such as coupons and principal of a bond) and the only outflow of cash is the purchase price, the NPV is simply the PV of future cash flows minus the purchase price (which is its own PV). NPV is a central tool in discounted cash flow (DCF) analysis, and is a standard method for using the time value of money to appraise long-term projects. Used for capital budgeting, and widely throughout economics, finance, and accounting, it measures the excess or shortfall of cash flows, in present value terms, once financing charges are met.

The NPV of a sequence of cash flows takes as input the cash flows and a discount rate or discount curve and outputs a price; the converse process in DCF analysis - taking a sequence of cash flows and a price as input and inferring as output a discount rate (the discount rate which would yield the given price as NPV) - is called the yield, and is more widely used in bond trading.

Contents

Formula

Each cash inflow/outflow is discounted back to its present value (PV). Then they are summed. Therefore NPV is the sum of all terms,

where

- t - the time of the cash flow

- i - the discount rate (the rate of return that could be earned on an investment in the financial markets with similar risk.); the opportunity cost of capital

- Rt - the net cash flow (the amount of cash, inflow minus outflow) at time t. For educational purposes, R0 is commonly placed to the left of the sum to emphasize its role as (minus) the investment.

The result of this formula if multiplied with the Annual Net cash in-flows and reduced by Initial Cash outlay the present value but in case where the cash flows are not equal in amount then the previous formula will be used to determine the present value of each cash flow separately. Any cash flow within 12 months will not be discounted for NPV purpose.[2]

The discount rate

Main article: Discount rateThe rate used to discount future cash flows to the present value is a key variable of this process.

A firm's weighted average cost of capital (after tax) is often used, but many people believe that it is appropriate to use higher discount rates to adjust for risk or other factors. A variable discount rate with higher rates applied to cash flows occurring further along the time span might be used to reflect the yield curve premium for long-term debt.

Another approach to choosing the discount rate factor is to decide the rate which the capital needed for the project could return if invested in an alternative venture. If, for example, the capital required for Project A can earn five percent elsewhere, use this discount rate in the NPV calculation to allow a direct comparison to be made between Project A and the alternative. Related to this concept is to use the firm's Reinvestment Rate. Reinvestment rate can be defined as the rate of return for the firm's investments on average. When analyzing projects in a capital constrained environment, it may be appropriate to use the reinvestment rate rather than the firm's weighted average cost of capital as the discount factor. It reflects opportunity cost of investment, rather than the possibly lower cost of capital.

An NPV calculated using variable discount rates (if they are known for the duration of the investment) better reflects the real situation than one calculated from a constant discount rate for the entire investment duration. Refer to the tutorial article written by Samuel Baker[3] for more detailed relationship between the NPV value and the discount rate.

For some professional investors, their investment funds are committed to target a specified rate of return. In such cases, that rate of return should be selected as the discount rate for the NPV calculation. In this way, a direct comparison can be made between the profitability of the project and the desired rate of return.

To some extent, the selection of the discount rate is dependent on the use to which it will be put. If the intent is simply to determine whether a project will add value to the company, using the firm's weighted average cost of capital may be appropriate. If trying to decide between alternative investments in order to maximize the value of the firm, the corporate reinvestment rate would probably be a better choice.

Using variable rates over time, or discounting "guaranteed" cash flows differently from "at risk" cash flows may be a superior methodology, but is seldom used in practice. Using the discount rate to adjust for risk is often difficult to do in practice (especially internationally), and is difficult to do well. An alternative to using discount factor to adjust for risk is to explicitly correct the cash flows for the risk elements using rNPV or a similar method, then discount at the firm's rate.

NPV in decision making

NPV is an indicator of how much value an investment or project adds to the firm. With a particular project, if Rt is a positive value, the project is in the status of discounted cash inflow in the time of t. If Rt is a negative value, the project is in the status of discounted cash outflow in the time of t. Appropriately risked projects with a positive NPV could be accepted. This does not necessarily mean that they should be undertaken since NPV at the cost of capital may not account for opportunity cost, i.e. comparison with other available investments. In financial theory, if there is a choice between two mutually exclusive alternatives, the one yielding the higher NPV should be selected.

If... It means... Then... NPV > 0 the investment would add value to the firm the project may be accepted NPV < 0 the investment would subtract value from the firm the project should be rejected NPV = 0 the investment would neither gain nor lose value for the firm We should be indifferent in the decision whether to accept or reject the project. This project adds no monetary value. Decision should be based on other criteria, e.g. strategic positioning or other factors not explicitly included in the calculation. Example

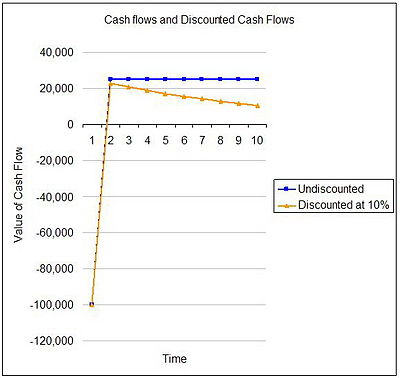

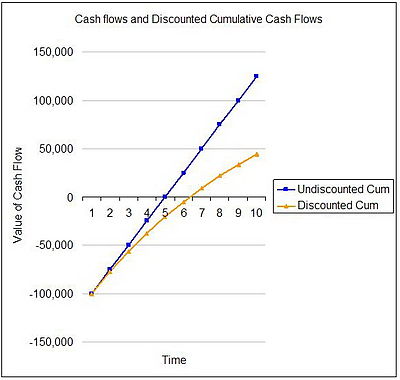

A corporation must decide whether to introduce a new product line. The new product will have startup costs, operational costs, and incoming cash flows over six years. This project will have an immediate (t=0) cash outflow of $100,000 (which might include machinery, and employee training costs). Other cash outflows for years 1–6 are expected to be $5,000 per year. Cash inflows are expected to be $30,000 each for years 1–6. All cash flows are after-tax, and there are no cash flows expected after year 6. The required rate of return is 10%. The present value (PV) can be calculated for each year:

Year Cash flow Present value T=0

-$100,000 T=1

$22,727 T=2

$20,661 T=3

$18,783 T=4

$17,075 T=5

$15,523 T=6

$14,112 The sum of all these present values is the net present value, which equals $8,881.52. Since the NPV is greater than zero, it would be better to invest in the project than to do nothing, and the corporation should invest in this project if there is no mutually exclusive alternative with a higher NPV.

The same example in Excel formulae:

- NPV(rate,net_inflow)+initial_investment

- PV(rate,year_number,yearly_net_inflow)

More realistic problems would need to consider other factors, generally including the calculation of taxes, uneven cash flows, and Terminal Value as well as the availability of alternate investment opportunities.

Common pitfalls

- If, for example, the Rt are generally negative late in the project (e.g., an industrial or mining project might have clean-up and restoration costs), than at that stage the company owes money, so a high discount rate is not cautious but too optimistic. Some people see this as a problem with NPV. A way to avoid this problem is to include explicit provision for financing any losses after the initial investment, that is, explicitly calculate the cost of financing such losses.

- Another common pitfall is to adjust for risk by adding a premium to the discount rate. Whilst a bank might charge a higher rate of interest for a risky project, that does not mean that this is a valid approach to adjusting a net present value for risk, although it can be a reasonable approximation in some specific cases. One reason such an approach may not work well can be seen from the following: if some risk is incurred resulting in some losses, then a discount rate in the NPV will reduce the impact of such losses below their true financial cost. A rigorous approach to risk requires identifying and valuing risks explicitly, e.g. by actuarial or Monte Carlo techniques, and explicitly calculating the cost of financing any losses incurred.

- Yet another issue can result from the compounding of the risk premium. R is a composite of the risk free rate and the risk premium. As a result, future cash flows are discounted by both the risk-free rate as well as the risk premium and this effect is compounded by each subsequent cash flow. This compounding results in a much lower NPV than might be otherwise calculated. The certainty equivalent model can be used to account for the risk premium without compounding its effect on present value.[citation needed]

- Another issue with relying on NPV is that it does not provide an overall picture of the gain or loss of executing a certain project. To see a percentage gain relative to the investments for the project, usually, Internal rate of return or other efficiency measures are used as a complement to NPV.

- Non specialist users frequently make the error of computing NPV based on cash flows after interest. This is wrong because it double counts the time value of money. Free Cash flow should be used as the basis for NPV computations.

History

Net present value as a valuation methodology dates at least to the 19th century. Karl Marx refers to NPV as fictitious capital, and the calculation as capitalising, writing:[4]

The forming of a fictitious capital is called capitalising. Every periodically repeated income is capitalised by calculating it on the average rate of interest, as an income which would be realised by a capital at this rate of interest.

In mainstream neo-classical economics, NPV was formalized and popularized by Irving Fisher, in his 1907 The Rate of Interest and became included in textbooks from the 1950s onwards, starting in finance texts.[5][6]

Alternative capital budgeting methods

- Adjusted present value (APV): adjusted present value, is the net present value of a project if financed solely by ownership equity plus the present value of all the benefits of financing.

- Accounting rate of return (ARR): a ratio similar to IRR and MIRR

- Cost-benefit analysis: which includes issues other than cash, such as time savings.

- Internal rate of return: which calculates the rate of return of a project while disregarding the absolute amount of money to be gained.

- Modified internal rate of return (MIRR): similar to IRR, but it makes explicit assumptions about the reinvestment of the cash flows. Sometimes it is called Growth Rate of Return.

- Payback period: which measures the time required for the cash inflows to equal the original outlay. It measures risk, not return.

- Real option method: which attempts to value managerial flexibility that is assumed away in NPV.

References

- ^ Lin, Grier C. I.; Nagalingam, Sev V. (2000). CIM justification and optimisation. London: Taylor & Francis. pp. 36. ISBN 0-7484-0858-4.

- ^ Khan, M.Y. (1993). Theory & Problems in Financial Management. Boston: McGraw Hill Higher Education. ISBN 9780074636831.

- ^ Baker, Samuel L. (2000). "Perils of the Internal Rate of Return". http://hspm.sph.sc.edu/COURSES/ECON/invest/invest.html. Retrieved January 12, 2007.

- ^ Karl Marx, Capital, Volume 3, 1909 edition, p. 548

- ^ Bichler, Shimshon; Nitzan, Jonathan (July 2010), Systemic Fear, Modern Finance and the Future of Capitalism, Jerusalem and Montreal, pp. 8–11 (for discussion of history of use of NPV as "capitalisation"), http://bnarchives.yorku.ca/289/03/20100700_bn_systemic_fear_modern_finance_future_of_capitalism.pdf

- ^ Nitzan, Jonathan; Bichler, Shimshon (2009), Capital as Power. A Study of Order and Creorder., RIPE Series in Global Political Economy, New York and London: Routledge

Corporate finance and investment banking Capital structure

Transactions

(terms / conditions)Initial public offering (IPO) · Secondary market offering (SEO) · Follow-on offering · Rights issue · Private placement · Spin out · Equity carve-out · Greenshoe (Reverse) · Book building · Bookrunner · UnderwriterValuation Financial modeling · Free cash flow · Business valuation · Fairness opinion · Stock valuation · APV · DCF · Net present value (NPV) · Cost of capital (Weighted average) · Comparable company analysis · Accretion/dilution analysis · Enterprise value · Tax shield · Minority interest · Associate company · EVA · MVA · Terminal value · Real options valuationCategories:- Basic financial concepts

- Mathematical finance

- Investment

- Management accounting

Wikimedia Foundation. 2010.