- Exchange rate

-

Foreign exchange Exchange rates

Currency band

Exchange rate

Exchange rate regime

Exchange rate flexibility

Dollarization

Fixed exchange rate

Floating exchange rate

Linked exchange rate

Managed float regimeMarkets

Foreign exchange market

Futures exchange

Retail forexAssets

Currency

Currency future

Non-deliverable forward

Forex swap

Currency swap

Foreign exchange optionHistorical agreements

Bretton Woods Conference

Smithsonian Agreement

Plaza Accord

Louvre AccordSee also

Bureau de change / currency exchange (office)

Hard currencyIn finance, an exchange rate (also known as the foreign-exchange rate, forex rate or FX rate) between two currencies is the rate at which one currency will be exchanged for another. It is also regarded as the value of one country’s currency in terms of another currency.[1] For example, an interbank exchange rate of 91 Japanese yen (JPY, ¥) to the United States dollar (US$) means that ¥91 will be exchanged for each US$1 or that US$1 will be exchanged for each ¥91. Exchange rates are determined in the foreign exchange market,[2] which is open to a wide range of different types of buyers and sellers where currency trading is continuous: 24 hours a day except weekends, i.e. trading from 20:15 GMT on Sunday until 22:00 GMT Friday. The spot exchange rate refers to the current exchange rate. The forward exchange rate refers to an exchange rate that is quoted and traded today but for delivery and payment on a specific future date.

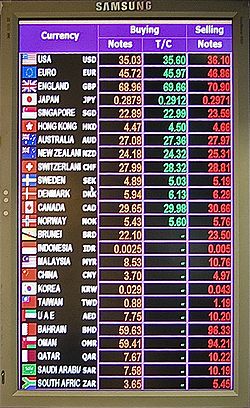

In the retail currency exchange market, a different buying rate and selling rate will be quoted by money dealers. Most trades are to or from the local currency. The buying rate is the rate at which money dealers will buy foreign currency, and the selling rate is the rate at which they will sell the currency. The quoted rates will incorporate an allowance for a dealer's margin (or profit) in trading, or else the margin may be recovered in the form of a "commission" or in some other way. Different rates may also be quoted for cash (usually notes only), a documentary form (such as traveller's cheques) or electronically (such as a credit card purchase). The higher rate on documentary transactions is due to the additional time and cost of clearing the document, while the cash is available for resale immediately. Some dealers on the other hand prefer documentary transactions because of the security concerns with cash.

Retail exchange market

People may need to exchange currencies in a number of situations. For example, people intending to travel to another country may buy foreign currency in a bank in their home country, where they may buy foreign currency cash, traveller's cheques or a travel-card. From a local money changer they can only buy foreign cash. At the destination, the traveller can buy local currency at the airport, either from a dealer or through an ATM. They can also buy local currency at their hotel, a local money changer, through an ATM, or at a bank branch. When they purchase goods in a store and they do not have local currency, they can use a credit card, which will convert to the purchaser's home currency at its prevailing exchange rate. If they have traveller's cheques or a travel card in the local currency, no currency exchange is necessary. Then, if a traveller has any foreign currency left over on their return home, may want to sell it, which they may do at their local bank or money changer. The exchange rate as well as fees and charges can vary significantly on each of these transactions, and the exchange rate can vary from one day to the next.

There are variations in the quoted buying and selling rates for a currency between foreign exchange dealers and forms of exchange, and these variations can be significant. For example, consumer exchange rates used by Visa and MasterCard offer the most favorable exchange rates available, according to a Currency Exchange Study conducted by CardHub.com.[3] This study, which examined the U.S. dollar-to-Euro exchange rates provided by the major worldwide credit card networks, 15 of the largest consumer banks in the U.S., and Travelex, showed that the credit card networks save travelers about 8% relative to banks and roughly 15% relative to airport companies.[3]

Quotations

Main article: Currency pairAn exchange rate is usually quoted in terms of the number of units of one currency that can be exchanged for one unit of another currency - e.g., in the form: 1.2290 EUR/USD. In this example, the US$ is referred to as the "quote currency" (price currency, payment currency) and the Euro is the "base currency" (unit currency, transaction currency).

There is a market convention that determines which is the base currency and which is the term currency. In most parts of the world, the order is: EUR – GBP – AUD – NZD – USD – others. Accordingly, a conversion from EUR to AUD, EUR is the base currency, AUD is the term currency and the exchange rate indicates how many Australian dollars would be paid or received for 1 Euro. Cyprus and Malta which were quoted as the base to the USD and others were recently removed from this list when they joined the Euro.

In some areas of Europe and in the non-professional market in the UK, EUR and GBP are reversed so that GBP is quoted as the base currency to the euro. In order to determine which is the base currency where both currencies are not listed (i.e. both are "other"), market convention is to use the base currency which gives an exchange rate greater than 1.000. This avoids rounding issues and exchange rates being quoted to more than 4 decimal places. There are some exceptions to this rule e.g. the Japanese often quote their currency as the base to other currencies.

Quotes using a country's home currency as the price currency (e.g., EUR 0.735342 = USD 1.00 in the euro zone) are known as direct quotation or price quotation (from that country's perspective)[4] and are used by most countries.

Quotes using a country's home currency as the unit currency (e.g., EUR 1.00 = USD 1.35991 in the euro zone) are known as indirect quotation or quantity quotation and are used in British newspapers and are also common in Australia, New Zealand and the eurozone.

Using direct quotation, if the home currency is strengthening (i.e., appreciating, or becoming more valuable) then the exchange rate number decreases. Conversely if the foreign currency is strengthening, the exchange rate number increases and the home currency is depreciating.

Market convention from the early 1980s to 2006 was that most currency pairs were quoted to 4 decimal places for spot transactions and up to 6 decimal places for forward outrights or swaps. (The fourth decimal place is usually referred to as a "pip"). An exception to this was exchange rates with a value of less than 1.000 which were usually quoted to 5 or 6 decimal places. Although there is no fixed rule, exchange rates with a value greater than around 20 were usually quoted to 3 decimal places and currencies with a value greater than 80 were quoted to 2 decimal places. Currencies over 5000 were usually quoted with no decimal places (e.g. the former Turkish Lira). e.g. (GBPOMR : 0.765432 - EURUSD : 1.5877 - GBPBEF : 58.234 - EURJPY : 165.29). In other words, quotes are given with 5 digits. Where rates are below 1, quotes frequently include 5 decimal places.

In 2005 Barclays Capital broke with convention by offering spot exchange rates with 5 or 6 decimal places on their electronic dealing platform.[5] The contraction of spreads (the difference between the bid and offer rates) arguably necessitated finer pricing and gave the banks the ability to try and win transaction on multibank trading platforms where all banks may otherwise have been quoting the same price. A number of other banks have now followed this system.

Exchange rate regime

Main article: Exchange rate regimeEach country, through varying mechanisms, manages the value of its currency. As part of this function, it determines the exchange rate regime that will apply to its currency. For example, the currency may be free-floating, pegged or fixed, or a hybrid.

If a currency is free-floating, its exchange rate is allowed to vary against that of other currencies and is determined by the market forces of supply and demand. Exchange rates for such currencies are likely to change almost constantly as quoted on financial markets, mainly by banks, around the world.

A movable or adjustable peg system is a system of fixed exchange rates, but with a provision for the devaluation of a currency. For example, between 1994 and 2005, the Chinese yuan renminbi (RMB) was pegged to the United States dollar at RMB 8.2768 to $1. China was not the only country to do this; from the end of World War II until 1967, Western European countries all maintained fixed exchange rates with the US dollar based on the Bretton Woods system. [1] But that system had to be abandoned due to market pressures and speculations in the 1970s in favor of floating, market-based regimes.

Still, some governments keep their currency within a narrow range. As a result currencies become over-valued or under-valued, causing trade deficits or surpluses.

Fluctuations in exchange rates

A market based exchange rate will change whenever the values of either of the two component currencies change. A currency will tend to become more valuable whenever demand for it is greater than the available supply. It will become less valuable whenever demand is less than available supply (this does not mean people no longer want money, it just means they prefer holding their wealth in some other form, possibly another currency).

Increased demand for a currency can be due to either an increased transaction demand for money or an increased speculative demand for money. The transaction demand is highly correlated to a country's level of business activity, gross domestic product (GDP), and employment levels. The more people that are unemployed, the less the public as a whole will spend on goods and services. Central banks typically have little difficulty adjusting the available money supply to accommodate changes in the demand for money due to business transactions.

Speculative demand is much harder for central banks to accommodate, which they influence by adjusting interest rates. A speculator may buy a currency if the return (that is the interest rate) is high enough. In general, the higher a country's interest rates, the greater will be the demand for that currency. It has been argued[by whom?] that such speculation can undermine real economic growth, in particular since large currency speculators may deliberately create downward pressure on a currency by shorting in order to force that central bank to sell their currency to keep it stable. (When that happens, the speculator can buy the currency back from the bank at a lower price, close out their position, and thereby take a profit.)[citation needed]

Purchasing power of currency

The "real exchange rate" (RER) is the purchasing power of a currency relative to another. It is based on the GDP deflator measurement of the price level in the domestic and foreign countries (P,Pf), which is arbitrarily set equal to 1 in a given base year. Therefore, the level of the RER is arbitrarily set depending on which year is chosen as the base year for the GDP deflator of two countries. The changes of the RER are instead informative on the evolution over time of the relative price of a unit of GDP in the foreign country in terms of GDP units of the domestic country. If all goods were freely tradable, and foreign and domestic residents purchased identical baskets of goods, purchasing power parity (PPP) would hold for the GDP deflators of the two countries, and the RER would be constant and equal to one.

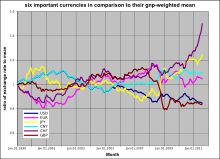

Bilateral vs. effective exchange rate

Bilateral exchange rate involves a currency pair, while an effective exchange rate is a weighted average of a basket of foreign currencies, and it can be viewed as an overall measure of the country's external competitiveness. A nominal effective exchange rate (NEER) is weighted with the inverse of the asymptotic trade weights. A real effective exchange rate (REER) adjusts NEER by appropriate foreign price level and deflates by the home country price level. Compared to NEER, a GDP weighted effective exchange rate might be more appropriate considering the global investment phenomenon.

Uncovered interest rate parity

Uncovered interest rate parity (UIRP) states that an appreciation or depreciation of one currency against another currency might be neutralized by a change in the interest rate differential. If US interest rates increase while Japanese interest rates remain unchanged then the US dollar should depreciate against the Japanese yen by an amount that prevents arbitrage (in reality the opposite, appreciation, quite frequently happens, as explained below). The future exchange rate is reflected into the forward exchange rate stated today. In our example, the forward exchange rate of the dollar is said to be at a discount because it buys fewer Japanese yen in the forward rate than it does in the spot rate. The yen is said to be at a premium.

UIRP showed no proof of working after the 1990s. Contrary to the theory, currencies with high interest rates characteristically appreciated rather than depreciated on the reward of the containment of inflation and a higher-yielding currency.

Balance of payments model

This model holds that a foreign exchange rate must be at its equilibrium level - the rate which produces a stable current account balance. A nation with a trade deficit will experience reduction in its foreign exchange reserves, which ultimately lowers (depreciates) the value of its currency. The cheaper currency renders the nation's goods (exports) more affordable in the global market place while making imports more expensive. After an intermediate period, imports are forced down and exports rise, thus stabilizing the trade balance and the currency towards equilibrium.

Like PPP, the balance of payments model focuses largely on trade-able goods and services, ignoring the increasing role of global capital flows. In other words, money is not only chasing goods and services, but to a larger extent, financial assets such as stocks and bonds. Their flows go into the capital account item of the balance of payments, thus balancing the deficit in the current account. The increase in capital flows has given rise to the asset market model.

Asset market model

See also: Capital asset pricing model and Net Capital OutflowThe expansion in trading of financial assets (stocks and bonds) has reshaped the way analysts and traders look at currencies. Economic variables such as economic growth, inflation and productivity are no longer the only drivers of currency movements. The proportion of foreign exchange transactions stemming from cross border-trading of financial assets has dwarfed the extent of currency transactions generated from trading in goods and services.

The asset market approach views currencies as asset prices traded in an efficient financial market. Consequently, currencies are increasingly demonstrating a strong correlation with other markets, particularly equities.

Like the stock exchange, money can be made or lost on the foreign exchange market by investors and speculators buying and selling at the right times. Currencies can be traded at spot and foreign exchange options markets. The spot market represents current exchange rates, whereas options are derivatives of exchange rates

Manipulation of exchange rates

Countries may gain an advantage in international trade if they manipulate the value of their currency by artificially keeping its value low, typically by the national central bank engaging in open_market operations. It is argued that the People's Republic of China has succeeded in doing this over a long period of time. However, in a real-world situation, a 2005 appreciation of the Yuan by 22% was followed by a 38.7% increase in Chinese imports to the US.[6][7]

In 2010, other nations, including Japan and Brazil, attempted to devalue their currency in the hopes of subsidizing cheap exports and bolstering their ailing economies. A low exchange rate lowers the price of a country's goods for consumers in other countries but raises the price of goods, especially imported goods, for consumers in the manipulating country.[8]

See also

- Bureau de Change

- Currency Pair

- Currency strength

- Effective exchange rate

- Euro calculator

- Foreign exchange market

- Forex scam

- Functional currency

- Tables of historical exchange rates to the USD

- USD Index

References

- ^ O'Sullivan, Arthur; Steven M. Sheffrin (2003). Economics: Principles in action. Upper Saddle River, New Jersey 07458: Pearson Prentice Hall. pp. 458. ISBN 0-13-063085-3. http://www.pearsonschool.com/index.cfm?locator=PSZ3R9&PMDbSiteId=2781&PMDbSolutionId=6724&PMDbCategoryId=&PMDbProgramId=12881&level=4.

- ^ The Economist – Guide to the Financial Markets (pdf)

- ^ a b "Currency Exchange Study". CardHub.com. http://education.cardhub.com/currency-exchange-study/.

- ^ Understanding foreign exchange: exchange rates

- ^ http://www.finextra.com/fullstory.asp?id=13480

- ^ "Appreciate This: Chinese Currency Rise Will Have a Negligible Effect on the Trade Deficit" article by Daniel J. Ikenson in The Cato Institute March 24, 2010

- ^ "Economists Ignore the Facts in Supporting Chinese Currency Legislation" article by Daniel Ikenson in The Cato Institute October 1, 2010

- ^ "More Countries Adopt China’s Tactics on Currency" article by David E. Sanger and Michael Wines in The New York Times October 3, 2010, accessed October 4, 2010

Categories:

Wikimedia Foundation. 2010.