- Consumer choice

-

Economics  Economies by region

Economies by regionGeneral categories Microeconomics · Macroeconomics

History of economic thought

Methodology · Mainstream & heterodoxTechnical methods Mathematical economics

Game theory · Optimization

Computational · Econometrics

Experimental · National accountingFields and subfields Behavioral · Cultural · Evolutionary

Growth · Development · History

International · Economic systems

Monetary and Financial economics

Public and Welfare economics

Health · Education · Welfare

Population · Labour · Managerial

Business · Information

Industrial organization · Law

Agricultural · Natural resource

Environmental · Ecological

Urban · Rural · Regional · GeographyLists Business and Economics Portal Consumer choice is a theory of microeconomics that relates preferences for consumption goods and services to consumption expenditures and ultimately to consumer demand curves. The link between personal preferences, consumption, and the demand curve is one of the most closely studied relations in economics. Consumer choice theory is a way of analyzing how consumers may achieve equilibrium between preferences and expenditures by maximizing utility as subject to consumer budget constraints.

Preferences are the desires by each individual for the consumption of goods and services that translate into choices based on income or wealth for purchases of goods and services to be combined with the consumer's time to define consumption activities.

Consumption is separated from production, logically, because two different consumers are involved. In the first case consumption is by the primary individual; in the second case, a producer might make something that he would not consume himself. Therefore, different motivations and abilities are involved.

The models that make up consumer theory are used to represent prospectively observable demand patterns for an individual buyer on the hypothesis of constrained optimization.

Prominent variables used to explain the rate at which the good is purchased (demanded) are the price per unit of that good, prices of related goods, and wealth of the consumer.

The fundamental theorem of demand states that the rate of consumption falls as the price of the good rises. This is called the substitution effect. Clearly if one does not have enough money to pay the price then they cannot buy any of that item. As prices rise, consumers will substitute away from higher priced goods and services, choosing less costly alternatives. Subsequently, as the wealth of the individual rises, demand increases, shifting the demand curve higher at all rates of consumption. This is called the income effect. As wealth rises, consumers will substitute away from less costly inferior goods and services, choosing higher priced alternatives.

Contents

Model setup

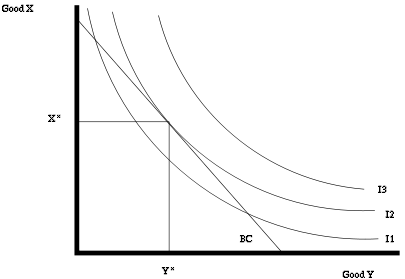

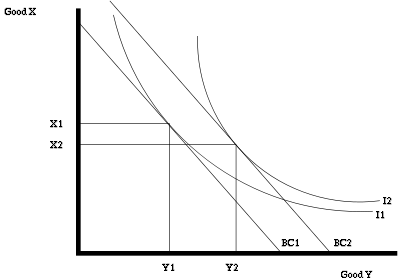

Further information: Indifference curve and Budget constraintEconomists' modern solution to the problem of mapping consumer choices is indifference curve analysis. For an individual, indifference curves and an assumption of constant prices and a fixed income in a two-good world will give the following diagram. The consumer can choose any point on or below the budget constraint line BC. This line is diagonal since it comes from the equation

. In other words, the amount spent on both goods together is less than or equal to the income of the consumer. The consumer will choose the indifference curve with the highest utility that is within his budget constraint. Every point on I3 is outside his budget constraint so the best that he can do is the single point on I2 that is tangent to his budget constraint. He will purchase X* of good X and Y* of good Y.

. In other words, the amount spent on both goods together is less than or equal to the income of the consumer. The consumer will choose the indifference curve with the highest utility that is within his budget constraint. Every point on I3 is outside his budget constraint so the best that he can do is the single point on I2 that is tangent to his budget constraint. He will purchase X* of good X and Y* of good Y.Indifference curve analysis begins with the utility function. The utility function is treated as an index of utility.[1] All that is necessary is that the utility index change as more preferred bundles are consumed. Indifference curves are typically numbered with the number increasing as more preferred bundles are consumed. However, it is not necessary that numbers be used - any indexing system would suffice - colors for example. The advantage of numbers is that their use makes the math simpler. Numbers used to index indifference curves have no cardinal significance. For example if three indifference curves are labeled 1, 4, and 16 respectively that means nothing more than the bundles "on" indifference curve 4 are more preferred than the bundles "on" indifference curve I. The fact that the index number is a multiple of another is of no significance. For example, the bundles of good on 4 does not mean that they are four times more satisfying than those on 1. As noted they merely mean they are more satisfying.

Income effect and price effect deal with how the change in price of a commodity changes the consumption of the good. The theory of consumer choice examines the trade-offs and decisions people make in their role as consumers as prices and their income changes.

Substitution effect

Main article: Substitute goodThe substitution effect is the effect observed with changes in relative price of goods. This effect basically affects the movement along the curve.

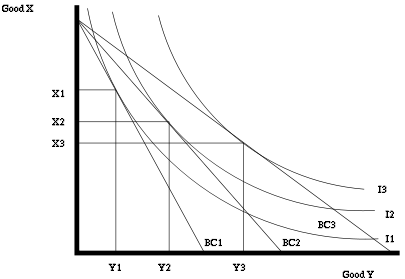

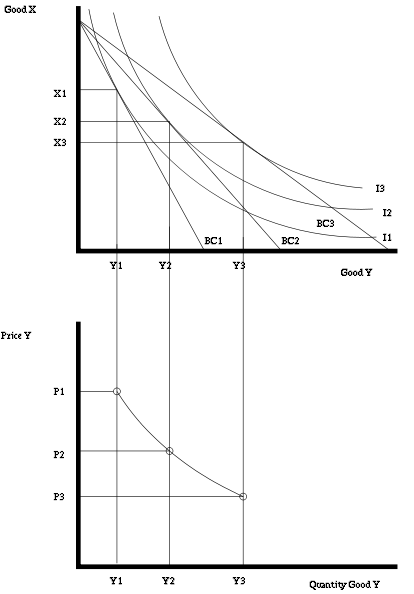

These curves can be used to predict the effect of changes to the budget constraint. The graphic below shows the effect of a price increase for good Y. If the price of Y increases, the budget constraint will pivot from BC2 to BC1. Notice that because the price of X does not change, the consumer can still buy the same amount of X if he or she chooses to buy only good X. On the other hand, if the consumer chooses to buy only good Y, he or she will be able to buy less of good Y because its price has increased.

To maximize the utility with the reduced budget constraint, BC1, the consumer will re-allocate consumption to reach the highest available indifference curve which BC1 is tangent to. As shown on the diagram below, that curve is I1, and therefore the amount of good Y bought will shift from Y2 to Y1, and the amount of good X bought to shift from X2 to X1. The opposite effect will occur if the price of Y decreases causing the shift from BC2 to BC3, and I2 to I3.

If these curves are plotted for many different prices of good Y, a demand curve for good Y can be constructed. The diagram below shows the demand curve for good Y as its price varies. Alternatively, if the price for good Y is fixed and the price for good X is varied, a demand curve for good X can be constructed.

Income effect

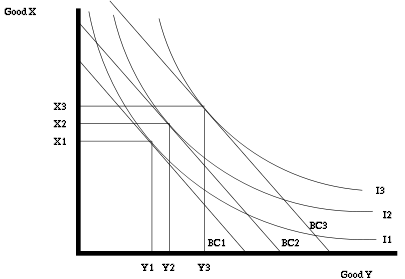

Main article: Income effectAnother important item that can change is the money income of the consumer. The income effect is the phenomenon observed through changes in purchasing power. It reveals the change in quantity demanded brought by a change in real income (utility). Graphically, as long as the prices remain constant, changing the income will create a parallel shift of the budget constraint. Increasing the income will shift the budget constraint right since more of both can be bought, and decreasing income will shift it left.

Depending on the indifference curves, as income increases, the amount purchased of a good can either increase, decrease or stay the same. In the diagram below, good Y is a normal good since the amount purchased increased as the budget constraint shifted from BC1 to the higher income BC2. Good X is an inferior good since the amount bought decreased as the income increases.

is the change in the demand for good 1 when we change income from m' to m, holding the price of good 1 fixed at p1':

is the change in the demand for good 1 when we change income from m' to m, holding the price of good 1 fixed at p1':

Price effect as sum of substitution and income effects

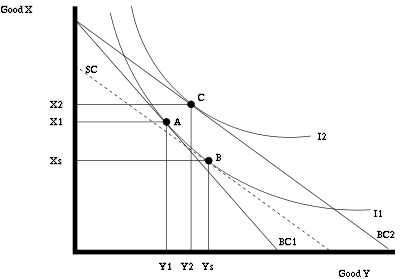

Further information: Slutsky equation and Hicksian demandEvery price change can be decomposed into an income effect and a substitution effect; the price effect is the sum of substitution and income effects.

The substitution effect is a price change that alters the slope of the budget constraint but leaves the consumer on the same indifference curve. In other words, it illustrates the consumer's new consumption basket after the price change while being compensated as to allow the consumer to be as happy as he or she was previously. By this effect, the consumer is posited to substitute toward the good that becomes comparatively less expensive. In the illustration below this corresponds to an imaginary budget constraint denoted SC being tangent to the indifference curve I1.

If the good in question is a normal good, then the income effect from the rise in purchasing power from a price fall reinforces the substitution effect. If the good is an inferior good, then the income effect will offset in some degree the substitution effect. If the income effect for an inferior good is sufficiently strong, the consumer will buy less of the good when it becomes less expensive, a Giffen good (commonly believed to be a rarity).

In the figure, the substitution effect,

, is the change in the amount demanded for

, is the change in the amount demanded for  when the price of good

when the price of good  falls from

falls from  to

to  (increasing purchasing power for

(increasing purchasing power for  ) and, at the same time, the money income falls from m to m' to keep the consumer at the same level of utility on

) and, at the same time, the money income falls from m to m' to keep the consumer at the same level of utility on  :

:

The substitution effect increases the amount demanded of good

from

from  to

to  . In the example, the income effect of the price fall in

. In the example, the income effect of the price fall in  partly offsets the substitution effect as the amount demanded of

partly offsets the substitution effect as the amount demanded of  goes from

goes from  to

to  . Thus, the price effect is the algebraic sum of the substitution effect and the income effect.

. Thus, the price effect is the algebraic sum of the substitution effect and the income effect.Assumptions

The behavioral assumption of consumer theory is that all consumers are rational decision makers who seek to maximize utility. More specifically, in the eyes of economists, all consumers seek to maximize a utility function subject to a budgetary constraint.[2] In other words, economists assume that consumers will always choose the "best" bundle of goods they can afford.[3] Consumer theory is therefore based around the problem of generate refutable hypotheses about the nature of consumer demand from this behavioral postulate.[2] In order to reason from the central postulate towards a useful model of consumer choice, it is necessary to make additional assumptions about the certain preferences that consumers employ when selecting their preferred "bundle" of goods. These are relatively strict, allowing for the model to generate more useful hypotheses with regard to consumer behaviour than weaker assumptions, which would allow any empirical data to be explained in terms of stupidity, ignorance, or some other factor, and hence would not be able to generate any predictions about future demand at all.[2] For the most part, however, they represent statements which would only be contradicted if a consumer was acting in (what was widely regarded as) a strange manner.[4] In this vein, the modern form of consumer choice theory assumes:

- Preferences are complete

- Consumer choice theory is based on the assumption that the consumer fully understands his or her own preferences, allowing for a simple but accurate comparison between any two bundles of good presented.[3] That is to say, it is assumed that if a consumer is presented with two consumption bundles A and B each containing different combinations of n goods, the consumer can unambiguously decide if (s)he prefers A to B, B to A, or is indifferent to both.[2][3] The few scenarios where it is possible to imagine that decision-making would be very difficult are thus placed "outside the domain of economic analysis".[3]

- Preferences are reflexive

- Means that if A and B are in all respect identical the consumer will consider a to be at least as good as (is weakly preferred) to B.[3] Alternatively, the axiom can be modified to read that the consumer is indifferent with regard to A and B.[5]

- Preference are transitive

- If A is preferred to B and B is preferred to C then A must be preferred to C.

- This also means that if the consumer is indifferent between A and B and is indifferent between B and C she will be indifferent between A and C.

- This is the consistency assumption. This assumption eliminates the possibility of intersecting indifference curves.

- Preferences exhibit non-satiation

- This is the "more is always better" assumption; that in general if a consumer is offered two almost identical bundles A and B, but where B includes more of one particular good, the consumer will choose B.[6] :Among other things this assumption precludes circular indifference curves. Non-satiation in this sense is not a necessary but a convenient assumption. It avoids unnecessary complications in the mathematical models.

- Indifference Curves exhibit diminishing marginal rates of substitution

- This assumption assures that indifference curves are smooth and convex to the origin.

- This assumption is implicit in the last assumption.

- This assumption also set the stage for using techniques of constrained optimization. Because the shape of the curve assures that the first derivative is negative and the second is positive.

- The MRS tells how much y a person is willing to sacrifice to get one more unit of x.

- This assumption incorporates the theory of diminishing marginal utility.

- The primary reason to have these technical preferences is to replicate the properties of the real number system so the math will work.

- Goods are available in all quantities

- It is assumed that a consumer may choose to purchase any quantity of a good (s)he desires, for example, 2.6 eggs and 4.23 loaves of bread. Whilst this makes the model less precise, it is generally acknowledged to provide a useful simplification to the calculations involved in consumer choice theory, especially since consumer demand is often examined over a considerable period of time. The more spending rounds are offered, the better approximation the continuous, differentiable function is for its discrete counterpart. (Whilst the purchase of 2.6 eggs sounds impossible, an average consumption of 2.6 eggs per day over a month does not.)[6]

Note the assumptions do not guarantee that the demand curve will be negatively sloped. A positively sloped curve is not inconsistent with the assumptions.[7]

Use Value

In Marx's critique of political economy, any labor-product has a value and a use value, and if it is traded as a commodity in markets, it additionally has an exchange value, most often expressed as a money-price.[8] Marx acknowledges that commodities being traded also have a general utility, implied by the fact that people want them, but he argues that this by itself tells us nothing about the specific character of the economy in which they are produced and sold.

Labor-leisure tradeoff

Main article: Backward bending supply curve of labourConsumer theory can also be used to analyze a consumer's choice between leisure and labor. Leisure is considered one good (often put on the horizontal-axis) and consumption is considered the other good. Since a consumer has a finite and scarce amount of time, he must make a choice between leisure (which earns no income for consumption) and labor (which does earn income for consumption).

The previous model of consumer choice theory is applicable with only slight modifications. First, the total amount of time that an individual has to allocate is known as his time endowment, and is often denoted as T. The amount an individual allocates to labor (denoted L) and leisure (l) is constrained by T such that:

or

A person's consumption is the amount of labor they choose multiplied by the amount they are paid per hour of labor (their wage, often denoted w). Thus, the amount that a person consumes is:

When a consumer chooses no leisure (l = 0) then T − l = T and C = wT.

From this labor-leisure tradeoff model, the substitution and income effects of various changes in price caused by welfare benefits, labor taxation, or tax credits can be analyzed.

See also

- Alpha consumer

- Budget constraint

- Convex preferences

- Cost the limit of price

- Endowment effect

- Important publications in consumer theory

- Indifference curves

- Microeconomics

- Price point

- Supply and demand

- Utility maximization problem

References

- ^ Silberberg & Suen 2001, p. 255

- ^ a b c d Silberberg & Suen 2001, pp. 252-254

- ^ a b c d e Varian 2006, p. 20

- ^ Silberberg & Suen 2001, p. 260

- ^ Binger & Hoffman 1998, pp. 109-17

- ^ a b Silberberg & Suen 2001, pp. 256-257

- ^ Binger & Hoffman 1998, pp. 141-143

- ^ http://www.marxists.org/glossary/terms/u/s.htm

- Silberberg; Suen (2001). The Structure of Economics, A Mathematical Analysis. McGraw-Hill.

- Böhm, Volker; Haller, Hans (1987). "Demand theory". The New Palgrave: A Dictionary of Economics. 1.

- Hicks, John R. (1946). Value and Capital (2nd ed.).

- Binger; Hoffman (1998). Microeconomics with Calculus (2nd ed.). Addison Wesley.

Microeconomics Major topics Aggregation · Budget · Consumer · Convexity and non-convexity · Cost · Cost-benefit analysis · Distribution · Deadweight loss · Income–consumption curve · Duopoly · Equilibria · Economies of scale · Economies of scope · Elasticity · Exchange · Expected utility · Externality · Firms · General equilibria · Household · Information · Indifference curve · Intertemporal choice · Marginal cost · Market failure · Market structure · Monopoly · Monopsony · Oligopoly · Opportunity cost · Preferences · Prices · Production · Profit · Public goods · Returns to scale · Risk · Scarcity · Shortage · Social choice · Sunk costs · Supply & demand · Surplus · Uncertainty · Utility · WelfareRelated Behavioral · Business · Computational · Decision theory · Econometrics · Experimental · Game theory · Industrial organization · Mathematical economics · Microfoundations of Macroeconomics · Managerial · Operations research · OptimizationCategories:- Consumer theory

- Household behavior and family economics

- Utilitarianism

- Microeconomics

Wikimedia Foundation. 2010.