- Patient Protection and Affordable Care Act

-

Patient Protection and Affordable Care Act

Full title The Patient Protection and Affordable Care Act. Acronym PPACA Colloquial name(s) Affordable Care Act, Healthcare Insurance Reform, Obamacare, Healthcare Reform Enacted by the 111th United States Congress Effective March 23, 2010

Specific provisions phased in through January 1, 2018Citations Public Law 111–148 Stat. 124 Stat. 119 through 124 Stat. 1025 (906 pages) Codification - Introduced in the House as the "Service Members Home Ownership Tax Act of 2009" (H.R. 3590) by Charles Rangel (D–NY) on September 17, 2009

- Committee consideration by: Ways and Means

- Passed the House on October 8, 2009 (416–0)

- Passed the Senate as the "Patient Protection and Affordable Care Act" on December 24, 2009 (60–39) with amendment

- House agreed to Senate amendment on March 21, 2010 (219–212)

- Signed into law by President Barack Obama on March 23, 2010

Major amendments Health Care and Education Reconciliation Act of 2010 Relevant Supreme Court cases None The Patient Protection and Affordable Care Act (PPACA)[1][2] is a United States federal statute signed into law by President Barack Obama on March 23, 2010. The law (along with the Health Care and Education Reconciliation Act of 2010) is the principal health care reform legislation of the 111th United States Congress. PPACA reforms certain aspects of the private health insurance industry and public health insurance programs, increases insurance coverage of pre-existing conditions, expands access to insurance to over 30 million Americans,[3][4] and increases projected national medical spending[5][6] despite lowering projected Medicare spending under previous law.[7]

PPACA passed the Senate on December 24, 2009, by a vote of 60–39 with all Democrats and two Independents voting for, and all Republicans voting against.[8] It passed the House of Representatives on March 21, 2010, by a vote of 219–212, with 34 Democrats and all 178 Republicans voting against the bill.[9]

A majority of the states, and numerous organizations and individual persons, have filed actions in federal court challenging the constitutionality of PPACA.[10] As of October 2011, the constitutionality of PPACA has been upheld by three out of four federal appellate courts, with the fourth declaring the law's individual mandate alone as unconstitutional.[11] The Supreme Court has agreed to review the suits,[12] and has scheduled over five hours for oral arguments on the matter in March 2012.[13]

Overview of provisions

President Barack Obama's signature on the bill.

President Barack Obama's signature on the bill.

PPACA includes numerous provisions to take effect over several years beginning in 2010. Policies issued before the law was promulgated are grandfathered from most federal regulations.

- Guaranteed issue and partial community rating will require insurers to offer the same premium to all applicants of the same age and geographical location without regard to most pre-existing conditions (excluding tobacco use).[15]

- A shared responsibility requirement, commonly called an individual mandate,[16] requires that nearly all persons not covered by Medicaid, Medicare, or other public insurance programs purchase an approved private insurance policy or pay a penalty, unless the applicable individual is a member of a recognized religious sect, exempted by the Internal Revenue Service, or waived in cases of financial hardship.[17]

- Medicaid eligibility is expanded to include all individuals and families with incomes up to 133% of the poverty level along with a simplified CHIP enrollment process.[18][19]

- Health insurance exchanges will commence operation in each state, offering a marketplace where individuals and small businesses can compare policies and premiums, and buy insurance (with a government subsidy if eligible).[20]

- Low income persons and families above the Medicaid level and up to 400% of the federal poverty level will receive federal subsidies[21] on a sliding scale if they choose to purchase insurance via an exchange (persons at 150% of the poverty level would be subsidized such that their premium cost would be of 2% of income or $50 a month for a family of 4).[22]

- Minimum standards for health insurance policies are to be established and annual and lifetime coverage caps will be prohibited.[23]

- Firms employing 50 or more people but not offering health insurance will also pay a shared responsibility requirement if the government has had to subsidize an employee's health care.[24]

- Very small businesses will be able to get subsidies if they purchase insurance through an exchange.[25]

- Insurance companies are required to spend a certain percent of premium dollars on medical care improvement; if an insurer fails to meet this requirement, a rebate must be issued to the policy holder.[26]

- Co-payments, co-insurance, and deductibles are to be eliminated for select health care insurance benefits considered to be part of an "essential benefits package"[27] for Level A or Level B preventive care.[28]

- Changes are enacted that allow a restructuring of Medicare reimbursement from "fee-for-service" to "bundled payments."[29][30]

- Additional support is provided for medical research and the National Institutes of Health.[31]

Summary of funding

The Act's provisions are intended to be funded by a variety of taxes and offsets. Major sources of new revenue include a much-broadened Medicare tax on incomes over $200,000 and $250,000, for individual and joint filers respectively, an annual fee on insurance providers, and a 40% tax on "Cadillac" insurance policies. There are also taxes on pharmaceuticals, high-cost diagnostic equipment, and a 10% federal sales tax on indoor tanning services. Offsets are from intended cost savings such as improved fairness in the Medicare Advantage program relative to traditional Medicare.[32]

Total new tax revenue from the Act will amount to $409.2 billion over the next 10 years. $78 billion will be realized before the end of fiscal 2014.[33] Summary of revenue sources:

- Broaden Medicare tax base for high-income taxpayers: $210.2 billion

- Annual fee on health insurance providers: $60 billion

- 40% excise tax on health coverage in excess of $10,200/$27,500: $32 billion

- Impose annual fee on manufacturers and importers of branded drugs: $27 billion

- Impose 2.3% excise tax on manufacturers and importers of certain medical devices: $20 billion

- Require information reporting on payments to corporations: $17.1 billion

- Raise 7.5% Adjusted Gross Income floor on medical expenses deduction to 10%: 15.2 billion

- Limit contributions to flexible spending arrangements in cafeteria plans to $2,500: $13 billion

- All other revenue sources: $14.9 billion

Provisions

The Act is divided into 10 titles[34] and contains provisions that became effective immediately, 90 days after enactment, and six months after enactment, as well as provisions that will become effective in 2014.[35][36]

Below are some of the key provisions of the Act. For simplicity, the amendments in the Health Care and Education Reconciliation Act of 2010 are integrated into this timeline.[37][38]

Effective at enactment

- The Food and Drug Administration is now authorized to approve generic versions of biologic drugs and grant biologics manufacturers 12 years of exclusive use before generics can be developed.[39]

- The Medicaid drug rebate for brand name drugs is increased to 23.1% (except the rebate for clotting factors and drugs approved exclusively for pediatric use increases to 17.1%), and the rebate is extended to Medicaid managed care plans; the Medicaid rebate for non-innovator, multiple source drugs is increased to 13% of average manufacturer price.[39]

- A non-profit Patient-Centered Outcomes Research Institute is established, independent from government, to undertake comparative effectiveness research.[39] This is charged with examining the "relative health outcomes, clinical effectiveness, and appropriateness" of different medical treatments by evaluating existing studies and conducting its own. Its 19-member board is to include patients, doctors, hospitals, drug makers, device manufacturers, insurers, payers, government officials and health experts. It will not have the power to mandate or even endorse coverage rules or reimbursement for any particular treatment. Medicare may take the Institute’s research into account when deciding what procedures it will cover, so long as the new research is not the sole justification and the agency allows for public input.[40] The bill forbids the Institute to develop or employ "a dollars per quality adjusted life year" (or similar measure that discounts the value of a life because of an individual’s disability) as a threshold to establish what type of health care is cost effective or recommended. This makes it different from the UK's National Institute for Health and Clinical Excellence.

- Creation of task forces on Preventive Services and Community Preventive Services to develop, update, and disseminate evidenced-based recommendations on the use of clinical and community prevention services.[39]

- The Indian Health Care Improvement Act is reauthorized and amended.[39]

Effective June 21, 2010

- Adults with pre-existing conditions became eligible to join a temporary high-risk pool, which will be superseded by the health care exchange in 2014.[36][41] To qualify for coverage, applicants must have a pre-existing health condition and have been uninsured for at least the past six months.[42] There is no age requirement.[42] The new program sets premiums as if for a standard population and not for a population with a higher health risk. Allows premiums to vary by age (4:1), geographic area, and family composition. Limit out-of-pocket spending to $5,950 for individuals and $11,900 for families, excluding premiums.[42][43][44]

Effective July 1, 2010

- The President established, within the Department of Health and Human Services (HHS), a council to be known as the National Prevention, Health Promotion and Public Health Council to help begin to develop a National Prevention and Health Promotion Strategy. The Surgeon General shall serve as the Chairperson of the new Council.[45][46]

- A 10% tax on indoor tanning took effect.[47]

Effective September 23, 2010

- Insurers are prohibited from imposing lifetime dollar limits on essential benefits, like hospital stays, in new policies issued.[48]

- Dependents (children) will be permitted to remain on their parents' insurance plan until their 26th birthday,[49] and regulations implemented under the Act include dependents that no longer live with their parents, are not a dependent on a parent’s tax return, are no longer a student, or are married.[50][51]

- Insurers are prohibited from excluding pre-existing medical conditions (except in grandfathered individual health insurance plans) for children under the age of 19.[52][53]

- Insurers are prohibited from charging co-payments, co-insurance, or deductibles for Level A or Level B preventive care and medical screenings on all new insurance plans.[54]

- Individuals affected by the Medicare Part D coverage gap will receive a $250 rebate, and 50% of the gap will be eliminated in 2011.[55] The gap will be eliminated by 2020.

- Insurers' abilities to enforce annual spending caps will be restricted, and completely prohibited by 2014.[36]

- Insurers are prohibited from dropping policyholders when they get sick.[36]

- Insurers are required to reveal details about administrative and executive expenditures.[36]

- Insurers are required to implement an appeals process for coverage determination and claims on all new plans.[36]

- Enhanced methods of fraud detection are implemented.[36]

- Medicare is expanded to small, rural hospitals and facilities.[36]

- Medicare patients with chronic illnesses must be monitored/evaluated on a 3 month basis for coverage of the medications for treatment of such illnesses.

- Non-profit Blue Cross insurers are required to maintain a loss ratio (money spent on procedures over money incoming) of 85% or higher to take advantage of IRS tax benefits.[36]

- Companies which provide early retiree benefits for individuals aged 55–64 are eligible to participate in a temporary program which reduces premium costs.[36]

- A new website installed by the Secretary of Health and Human Services will provide consumer insurance information for individuals and small businesses in all states.[36]

- A temporary credit program is established to encourage private investment in new therapies for disease treatment and prevention.[36]

Effective by January 1, 2011

- Insurers will be required to spend 85% of large-group and 80% of small-group and individual plan premiums (with certain adjustments) on healthcare or to improve healthcare quality, or return the difference to the customer as a rebate.[56]

- The Centers for Medicare and Medicaid Services is responsible for developing the Center for Medicare and Medicaid Innovation and overseeing the testing of innovative payment and delivery models.[57]

- Flexible spending accounts, Health reimbursement accounts and health savings accounts cannot be used to pay for over-the-counter drugs, purchased without a prescription, except insulin.[58]

Effective by January 1, 2012

- Employers must disclose the value of the benefits they provided beginning in 2012 for each employee's health insurance coverage on the employees' annual Form W-2's.[59] This requirement was originally to be effective January 1, 2011 but was postponed by IRS Notice 2010-69 on October 23, 2010.[60]

- New tax reporting changes were to come in effect to prevent tax evasion by corporations and individuals. However, in April 2011, Congress passed and Obama signed the Comprehensive 1099 Taxpayer Protection and Repayment of Exchange Subsidy Overpayments Act of 2011 repealing this provision, because it was burdensome to small businesses.[61][62] Under the repealed law, businesses would have been required to notify the IRS on form 1099 of certain payments to individuals for certain services or property over a reporting threshold of $600.[63][64] Reporting of payments to corporations and individuals would also be required.[65][66] Originally it was expected to raise $17 billion over 10 years.[67] The amendments made by Section 9006 of the Act were designed to apply to payments made by businesses after December 31, 2011, but will no longer apply because of the repeal of the section.[64][62]

Effective by January 1, 2013

- Income from self-employment and wages of single individuals in excess $200,000 annually will be subject to an additional tax of 0.9%. The threshold amount is $250,000 for a married couple filing jointly (threshold applies to joint compensation of the two spouses), or $125,000 for a married person filing separately.[68] In addition, an additional tax of 3.8% will apply to the lesser of net investment income or the amount by which adjusted gross income exceeds $200,000 ($250,000 for a married couple filing jointly; $125,000 for a married person filing separately.)[69]

Effective by January 1, 2014

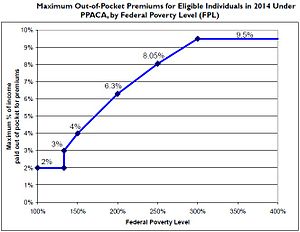

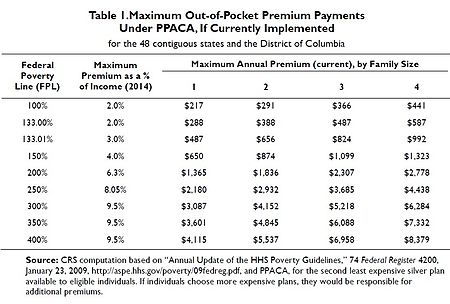

Maximum Out-of-Pocket Premium Payments Under PPACA by Family Size and federal poverty level.[14] (Source: CRS)

Maximum Out-of-Pocket Premium Payments Under PPACA by Family Size and federal poverty level.[14] (Source: CRS)

- Insurers are prohibited from discriminating against or charging higher rates for any individuals based on pre-existing medical conditions.[36][70]

- Impose an annual penalty of $95, or up to 1% of income, whichever is greater, on individuals who do not secure insurance; this will rise to $695, or 2.5% of income, by 2016. This is an individual limit; families have a limit of $2,085.[17][71] Exemptions to the fine in cases of financial hardship or religious beliefs are permitted.[17]

- Insurers are prohibited from establishing annual spending caps.[36]

- Expand Medicaid eligibility; all individuals with income up to 133% of the poverty line qualify for coverage, including adults without dependent children.[17][72]

- Two years of tax credits will be offered to qualified small businesses. In order to receive the full benefit of a 50% premium subsidy, the small business must have an average payroll per full time equivalent ("FTE") employee, excluding the owner of the business, of less than $25,000 and have fewer than 11 FTEs. The subsidy is reduced by 6.7% per additional employee and 4% per additional $1,000 of average compensation. As an example, a 16 FTE firm with a $35,000 average salary would be entitled to a 10% premium subsidy.[73]

- Impose a $2,000 per employee tax penalty on employers with more than 50 employees who do not offer health insurance to their full-time workers (as amended by the reconciliation bill).[74]

- Set a maximum of $2,000 annual deductible for a plan covering a single individual or $4,000 annual deductible for any other plan (see 111HR3590ENR, section 1302). These limits can be increased under rules set in section 1302.

- The CLASS Act provision would have created a voluntary long-term care insurance program, but in October 2011 the Department of Health and Human Services announced that the provision was unworkable and would be dropped, although an Obama administration official later said the President does not support repealing this provision.[75][76][77][78]

- Pay for new spending, in part, through spending and coverage cuts in Medicare Advantage, slowing the growth of Medicare provider payments (in part through the creation of a new Independent Payment Advisory Board), reducing Medicare and Medicaid drug reimbursement rate, cutting other Medicare and Medicaid spending.[38][79]

- Revenue increases from a new $2,500 limit on tax-free contributions to flexible spending accounts (FSAs), which allow for payment of health costs.[80]

- Chain restaurants and food vendors with 20 or more locations are required to display the caloric content of their foods on menus, drive-through menus, and vending machines. Additional information, such as saturated fat, carbohydrate, and sodium content, must also be made available upon request.[81]

- Establish health insurance exchanges, and subsidization of insurance premiums for individuals with income up to 400% of the poverty line, as well as single adults.[72][82][83] Section 1401(36B) of PPACA explains that the subsidy will be provided as an advanceable, refundable tax credit[84] and gives a formula for its calculation.[85] Refundable tax credit is a way to provide government benefit to people even with no tax liability[86] (example: Earned Income Credit). The formula was changed in the amendments (HR 4872) passed March 23, 2010, in section 1001. According to DHHS and CRS, in 2014 the income-based premium caps for a "silver" healthcare plan for family of four would be the following:

Health Insurance Premiums and Cost Sharing under PPACA for average family of 4.[87][14][88][89] Income % of federal poverty level Premium Cap as a Share of Income Income $ (family of 4)a Max Annual Out-of-Pocket Premium Premium Savingsb Additional Cost-Sharing Subsidy 133% 3% of income $31,900 $992 $10,345 $5,040 150% 4% of income $33,075 $1,323 $9,918 $5,040 200% 6.3% of income $44,100 $2,778 $8,366 $4,000 250% 8.05% of income $55,125 $4,438 $6,597 $1,930 300% 9.5% of income $66,150 $6,284 $4,628 $1,480 350% 9.5% of income $77,175 $7,332 $3,512 $1,480 400% 9.5% of income $88,200 $8,379 $2,395 $1,480 a.^ Note: In 2016, the FPL is projected to equal about $11,800 for a single person and about $24,000 for family of four.[90][91] See Subsidy Calculator for specific dollar amount.[92] b.^ DHHS and CBO estimate the average annual premium cost in 2014 to be $11,328 for family of 4 without the reform.[87]- The U.S. Department of Health and Human Services (DHHS) and Internal Revenue Service (IRS) on August 12, 2011, issued joint proposed rules regarding implementation of new state-based health insurance exchanges to cover how the exchanges will determine eligibility for uninsured individuals and employees of small businesses seeking to buy insurance on the exchanges, as well as how the exchanges will handle eligibility determinations for low-income individuals applying for newly expanded Medicaid benefits.[89][93][94] There will be a 75-day public comment period for the new DHHS rules.[94][95]

- Members of Congress and their staff will only be offered health care plans through the exchange or plans otherwise established by the bill (instead of the Federal Employees Health Benefits Program that they currently use).[96]

- A new excise tax goes into effect that is applicable to pharmaceutical companies and is based on the market share of the company; it is expected to create $2.5 billion in annual revenue.[71]

- Most medical devices become subject to a 2.3% excise tax collected at the time of purchase. (Reduced by the reconciliation act to 2.3% from 2.6%)[97]

- Health insurance companies become subject to a new excise tax based on their market share; the rate gradually raises between 2014 and 2018 and thereafter increases at the rate of inflation. The tax is expected to yield up to $14.3 billion in annual revenue.[71]

- The qualifying medical expenses deduction for Schedule A tax filings increases from 7.5% to 10% of earned income.[98]

Effective by January 1, 2017

- A state may apply to the Secretary of Health & Human Services for a "waiver for state innovation" provided that the state passes legislation implementing an alternative health care plan meeting certain criteria. The decision of whether to grant the waiver is up to the Secretary (who must annually report to Congress on the waiver process) after a public comment period.[99]

- A state receiving the waiver would be exempt from some of the central requirements of the ACA, including the individual mandate, the creation by the state of an insurance exchange, and the penalty for certain employers not providing coverage.[100][101] The state would also receive compensation equal to the aggregate amount of any federal subsidies and tax credits for which its residents and employers would have been eligible under the ACA plan, but which cannot be paid out due to the structure of the state plan.[99]

- In order to qualify for the waiver, the state plan must provide insurance at least as comprehensive and as affordable as that required by the ACA, must cover at least as many residents as the ACA plan would, and cannot increase the federal deficit. The coverage must continue to meet the consumer protection requirements of the ACA, such as the prohibition on increasing premiums because of pre-existing conditions.[102]

- A bipartisan bill sponsored by Senators Ron Wyden and Scott Brown, and supported by President Obama, proposes making waivers available in 2014 rather than 2017, so that, for example, states that wish to implement an alternative plan need not set up an insurance exchange only to dismantle it a short time later.[100]

- Vermont has announced its intention to pursue a waiver in order to implement the single-payer system enacted in May 2011.[103][104][105][106] Oregon is also expected to request a waiver.[107]

Effective by 2018

- All existing health insurance plans must cover approved preventive care and checkups without co-payment.[36]

- A new 40% excise tax on high cost ("Cadillac") insurance plans is introduced. The tax (as amended by the reconciliation bill)[108] is on the cost of coverage in excess of $27,500 (family coverage) and $10,200 (individual coverage), and it is increased to $30,950 (family) and $11,850 (individual) for retirees and employees in high risk professions. The dollar thresholds are indexed with inflation; employers with higher costs on account of the age or gender demographics of their employees may value their coverage using the age and gender demographics of a national risk pool.[71][109]

Impact

Public policy impact

Deficit impact

See also: United States public debtAs of the bill's passage into law, the CBO estimated the legislation would reduce the deficit by $143 billion[110] over the first decade, but half of that was due to expected premiums for the C.L.A.S.S. Act, which has since been abandoned.[111] Although the CBO generally does not provide cost estimates beyond the 10-year budget projection period (because of the great degree of uncertainty involved in the data) it decided to do so in this case at the request of lawmakers, and estimated a second decade deficit reduction of $1.2 trillion.[112][113] CBO predicted deficit reduction around a broad range of one-half percent of GDP over the 2020s while cautioning that "a wide range of changes could occur".[114]

The Congressional Budget Office (CBO) also initially stated that the bill would "substantially reduce the growth of Medicare's payment rates for most services; impose an excise tax on insurance plans with relatively high premiums; and make various other changes to the federal tax code, Medicare, Medicaid, and other programs;"[112] However, CBO was required to exclude from its initial estimates the effects of concurrent "doc fix" legislation that would increase Medicare payments by more than $200 billion from 2010-2019. The "doc fix" legislation—separate from Patient Protection and Affordable Care Act—was enacted to permanently replace annual "fixes" that had been enacted since 1997.[115][116][117][118][119] Subject to the same exclusion, the CBO initially estimated the federal government's share of the cost during the first decade at $940 billion, $923 billion of which takes place during the final six years (2014–2019) when the spending kicks in;[120][121] with revenue exceeding spending during these six years.[122]

There was mixed opinion about the CBO estimates from others.

Uwe Reinhardt, a Health economist at Princeton, wrote that "The rigid, artificial rules under which the Congressional Budget Office must score proposed legislation unfortunately cannot produce the best unbiased forecasts of the likely fiscal impact of any legislation", but went on to say "But even if the budget office errs significantly in its conclusion that the bill would actually help reduce the future federal deficit, I doubt that the financing of this bill will be anywhere near as fiscally irresponsible as was the financing of the Medicare Modernization Act of 2003."[123]

Douglas Holtz-Eakin, a former CBO director who served during the George W. Bush administration, opined that the bill would increase the deficit by $562 billion.[124]

Republican House leadership and the Republican majority on the House Budget Committee estimate the law would increase the deficit by more than $700 billion in its first 10 years.[125][126]

Democratic House leadership and the Democratic minority on the House Budget Committee say the claims of budget gimmickry are false[127] and that repeal of the legislation would increase the deficit by $230 billion over the same period,[128] pointing to the CBO's 2011 analysis of the impact of repeal.[129]

The New Republic editors Noam Scheiber (an economist) and Jonathan Cohn (a noted health care policy analyst), countered critical assessments of the law's deficit impact, arguing that it is as likely, if not more so, for predictions to have underestimated deficit reduction than to have overestimated it. They noted that it is easier, for example, to account for the cost of definite levels of subsidies to specified numbers of people than account for savings from preventive health care, and that the CBO has a track record of consistently overestimating the costs of, and underestimating the savings of health legislation;[130][131] "innovations in the delivery of medical care, like greater use of electronic medical records and financial incentives for more coordination of care among doctors, would produce substantial savings while also slowing the relentless climb of medical expenses... But the CBO would not consider such savings in its calculations, because the innovations hadn’t really been tried on such large scale or in concert with one another--and that meant there wasn’t much hard data to prove the savings would materialize."[131]

David Walker, former U.S. Comptroller General now working for The Peter G. Peterson Foundation, has stated that the CBO estimates are not likely to be accurate, because it is based on the assumption that Congress is going to do everything they say they're going to do.[132] On the other hand, a Center on Budget and Policy Priorities analysis said that Congress has a good record of implementing Medicare savings. According to their study, Congress implemented the vast majority of the provisions enacted in the past 20 years to produce Medicare savings.[133][134]

Change in number of uninsured

According to Congressional Budget Office estimates, the legislation will reduce the number of uninsured residents by 32 million, leaving 23 million uninsured residents in 2019 after the bill's provisions have all taken effect.[135] Among the people in this group will be:

- Illegal immigrants, estimated at almost a third of the 23 million, will be ineligible for insurance subsidies and Medicaid.[135][136][137] They will also be exempt from the health insurance mandate, but will remain eligible for emergency services under the 1986 Emergency Medical Treatment and Active Labor Act (EMTALA).

- Those who do not enroll in Medicaid despite being eligible.[138]

- Those who are not otherwise covered and opt to pay the annual penalty (2.5% of income, $695 for individuals, or a maximum of $2,250 per family) instead of purchasing (presumably more expensive) insurance; this might be mostly younger and single Americans.[138]

- Those whose insurance coverage would cost more than 8% of household income; they are exempt from paying the annual penalty.[138]

Early experience under the Act was that, as a result of the tax credit for small businesses, many of them offered health insurance to their employees for the first time.[139]

On September 13, 2011, the Census Bureau released a report showing that the number of uninsured 19-25 year olds (now eligible to stay on their parents' policies) had declined by 393,000, or 1.6%, both statistically significant.[140]

Effect on national spending

The United States Department of Health and Human Services reported that the bill would increase "total national health expenditures" by more than $200 billion from 2010-2019.[141][142] Looking at the federal budget implications, in a May 2010 presentation on "Health Costs and the Federal Budget," CBO stated:

- Rising health costs will put tremendous pressure on the federal budget during the next few decades and beyond. In CBO’s judgment, the health legislation enacted earlier this year does not substantially diminish that pressure.

CBO further observed that "a substantial share of current spending on health care contributes little if anything to people’s health" and concluded, "Putting the federal budget on a sustainable path would almost certainly require a significant reduction in the growth of federal health spending relative to current law (including this year’s health legislation)."[143]

For the effect on health insurance premiums, the CBO referred[112]:15 to its November 2009 analysis[144] and stated that the effects would "probably be quite similar" to that earlier analysis. That analysis forecasted that by 2016: for the non-group market comprising 17% of the market, premiums per person would increase by 10 to 13% but that over half of these insureds would receive subsidies which would decrease the premium paid to "well below" premiums charged under current law; for the small group market 13% of the market, premiums would be impacted 1 to −3% and −8 to −11% for those receiving subsidies; for the large group market comprising 70% of the market, premiums would be impacted 0 to −3%, with insureds under high premium plans subject to excise taxes being charged −9 to −12%. The analysis was affected by various factors including increased benefits particularly for the nongroup markets, more healthy insureds due to the mandate, administrative efficiencies related to the health exchanges, and insureds under high premium plans reducing benefits in response to the tax.[144]

Surgeon Atul Gawande has noted that bill contains a variety of pilot programs that may have a significant impact on cost and quality over the long-run, although these have not been factored into CBO cost estimates. He stated these pilot programs cover nearly every idea healthcare experts advocate, except malpractice/tort reform. He argued that a trial and error strategy, combined with industry and government partnership, is how the U.S. overcame a similar challenge in the agriculture industry in the early 20th century.[145]

The Business Roundtable, an association of CEOs, commissioned a report from the consulting company Hewitt Associates that found that the legislation "could potentially reduce that trend line by more than $3,000 per employee, to $25,435" with respect to insurance premiums. It also stated that the legislation "could potentially reduce the rate of future health care cost increases by 15% to 20% when fully phased in by 2019". The group cautioned that this is all assuming that the cost-saving government pilot programs both succeed and then are wholly copied by the private market, which is uncertain.[146]

The Office of the Actuary at the Centers for Medicare and Medicaid Services released a report in April 2010 saying that the PPACA would increase the number of Americans with health insurance coverage but would also increase projected spending by approximately 1% over 10 years. The report also cautioned that the increases could be larger, because the Medicare cuts in the law may be unrealistic and unsustainable, forcing lawmakers to roll them back. The report projected that Medicare cuts could put nearly 15% of hospitals and other institutional providers into debt, "possibly jeopardizing access" to care for seniors.[147][148] The Bill was described as "the federal government’s biggest attack on economic inequality since inequality began rising more than three decades ago".[149]

After the bill was signed, AT&T, Caterpillar, Verizon, and John Deere issued financial reports showing large current charges against earnings, up to US$1 billion in the case of AT&T, attributing the additional expenses to tax changes in the new health care law.[150] Under the new law as of 2013 companies can no longer deduct a subsidy for prescription drug benefits granted under Medicare Part D.[151]

Political impact

Public opinion

Public opinion supported healthcare reform proposals in 2008, but turned negative when the plan changed in 2009, and remains opposed to the final version that was signed in 2010. Though in 2008 then-Senators Barack Obama and Joseph Biden campaigned against requiring adults to buy insurance;[152] in 2009 President Obama reportedly "changed his mind" and agreed with insurance industry and Democratic Congressional proposals to include an individual mandate.[153][154] Public opinion of the legislation turned negative when the individual mandate proposal was announced, and remains opposed by a margin of 10 percentage points.[155][156][157] Specific ideas that showed majority support, such as purchasing drugs from Canada, limiting malpractice awards, and reducing the age to qualify for Medicare, were not enacted.[158]

In March 2010, pollsters probed the reasons for opposition. In a CNN poll, 62% of respondents said the Act would "increase the amount of money they personally spend on health care," 56% said the bill "gives the government too much involvement in health care," and only 19% said they and their families would be better off with the legislation.[159] In The Wall Street Journal, pollsters Scott Rasmussen and Doug Schoen wrote, "One of the more amazing aspects of the health-care debate is how steady public opinion has remained... 81% of voters say it's likely the plan will end up costing more than projected [and 59%] say that the biggest problem with the health-care system is the cost: They want reform that will bring down the cost of care. For these voters, the notion that you need to spend an additional trillion dollars doesn't make sense."[160] USA Today found opinions were starkly divided by age, with a solid majority of seniors opposing the bill and a solid majority of those younger than 40 in favor.[161]

In the November 2010 midterm election, Democrats lost more seats in Congress than any party in any midterm in more than 70 years. Politico reported that five House Democrats had run political ads highlighting their "no" votes on the bill, while there had not been any political ads highlighting a "yes" vote since April, when Harry Reid ran one.[162]

The Act is often referred to by the nickname "Obamacare", which has been characterized as pejorative[163][164][165] but continues to be widely used to refer to the legislation, largely by its opponents.[166] Use of the term in a positive sense has however been suggested by Democratic politicians such as John Conyers (D-MI).[167] President Obama said subsequently, "I have no problem with people saying Obama cares. I do care."[168] Because of the number of "Obamacare" search engine queries, the Department of Health and Human Services purchased Google advertisements, triggered by the term, to direct people to the official HHS site.[166]

Impact on child-only policies

In September 2010, some insurance companies announced that in response to the law, they would end the issuance of new child-only policies.[169][170] Kentucky Insurance Commissioner Sharon Clark said the decision by insurers to stop offering such policies was a violation of state law and ordered insurers to offer an open enrollment period in January 2011 for Kentuckians under 19.[171] An August 2011 Congressional report found that passage of the health care law prompted health insurance carriers to stop selling new child-only health plans in many states. Of the 50 states, 17 reported that there were currently no carriers selling child only health plans to new enrollees. Thirty-nine states indicated at least one insurance carrier exited the child-only market following enactment of the health care laws.[172]

Constitutional challenges

Challenges by states

Organizations and lawmakers who opposed the passage of the bill threatened to take legal action against it upon its passage[173] and several court challenges are currently at various stages of development. The target of the threatened lawsuits were several key provisions of the bill. Some claimed that fining individuals for failing to buy insurance is not within the scope of Congress's taxing powers. Idaho legislators passed a law that directed its attorney general to sue if mandatory insurance becomes federal law, which he duly did. A total of 28 states have filed joint or individual lawsuits (including 26 states engaged in a joint action) to overturn the individual mandate portions of the law.[174][175][176][176][177][178][179][180][181] In a press release, the Attorneys General for several states indicated their primary basis for the challenge was a violation of state sovereignty. Their release repeated the claim challenging the federal requirement under threat of penalty, that all citizens and legal residents have qualifying health care coverage. It also claimed that the law puts an unfair financial burden on state governments.[179] The lawsuit states the following legal rationale:

Regulation of non-economic activity under the Commerce Clause is possible only through the Necessary and Proper Clause. The Necessary and Proper Clause confers supplemental authority only when the means adopted to accomplish an enumerated power are 'appropriate', are 'plainly adapted to that end', and are 'consistent with the letter and spirit of the constitution.' Requiring citizen-to-citizen subsidy or redistribution is contrary to the foundational assumptions of the constitutional compact.[182]Other states were either expected to join the multi-state lawsuit or are considering filing additional independent suits.[177][183][184] Members of several state legislatures are attempting to counteract and prevent elements of the bill within their states. Legislators in 29 states have introduced measures to amend their constitutions to nullify portions of the health care reform law. Thirteen state statutes have been introduced to prohibit portions of the law; two states have already enacted statutory bans. Six legislatures had attempts to enact bans, but the measures were unsuccessful.[185] In August 2010, a ballot initiative passed overwhelmingly in Missouri that would exempt the state from some provisions of the bill. Most legal analysts expect that the measure will be struck down if challenged in Federal court.[186]

Reactions from legal experts

In February 2011, Alexander Bolton wrote in The Hill that consensus among legal experts largely changed following Judge Roger Vinson's decision in Florida et al v. United States Department of Health and Human Services. He said that prior to the ruling, it was widely felt that the Supreme Court would uphold the law by a comfortable margin, but now legal scholars generally feel it would be a 5–4 decision. Georgetown University Law Center professor Randy Barnett said, "There's been a big change in the conventional wisdom ... the temperature of law professors has changed considerably," and describing the Florida decision as "extremely deep in its discussion of principles and constitutional doctrine".[187]

Federal Court rulings

Federal District Court ruling from United States District Court for the Northern District of Florida

Further information: Florida et al v. United States Department of Health and Human ServicesOn January 31, 2011, Judge Roger Vinson in Florida et al v. United States Department of Health and Human Services declared the law unconstitutional in an action brought by 26 states, on the grounds that the individual mandate to purchase insurance exceeds the authority of Congress to regulate interstate commerce. Vinson further ruled the clause was not severable, which had the effect of striking down the entire law.[188][189]

On August 12, 2011, a divided three-judge panel of the 11th Circuit Court of Appeals affirmed Judge Vinson's decision in part: the court agreed that the mandate was unconstitutional, but held that it could be severed, allowing the rest of the PPACA to remain.[190]

In September 2011, the Department of Justice decided not to ask for an en banc review by the 11th Circuit, and instead asked the U.S. Supreme Court to hear the case.[191][192] On November 14, 2011, the Supreme Court agreed to hear the case, with oral arguments expected in March 2012 and a decision expected by June 2012.[13]

Commonwealth of Virginia v. Kathleen Sebelius

Further information: Commonwealth of Virginia v. SebeliusThe first federal court ruling in the legal challenges to the health care act came on August 2, 2010, in response to the suit brought by Virginia's attorney general. U.S. District Judge Henry E. Hudson denied the Justice Department's request to have the suit dismissed, citing the complex constitutional questions the law raises and writing that the PPACA "radically changes the landscape of health insurance coverage in America."

On December 12, 2010, in the first case rejecting the law's constitutionality, Judge Hudson ruled that the individual mandate was unconstitutional, and that the "tax" imposed on people who choose not to have a "minimum essential coverage plan" was in practice a "penalty" outside the federal government's constitutional authority to raise revenues. Judge Hudson stated he could find no precedent for extending either Commerce Clause or the General Welfare Clause to encompass regulation of a person’s decision not to purchase a product. He ruled the provision to be beyond the power given to Congress under the Commerce Clause. His ruling covered only Section 1501 of the Act, and severed that requirement without discussing the rest of the law.[193][194][195]

A three-judge panel from the 4th Circuit Court of Appeals unanimously ruled on September 8, 2011, that the state did not have the authority to challenge the law, saying "... we vacate the judgment of the district court and remand with instructions to dismiss the case for lack of subject-matter jurisdiction." [196] The state's attorney general said they planned to appeal the decision.

Appeals Court ruling from DC Court of Appeals

In Seven-Sky v. Holder, the U.S. Court of Appeals for the District of Columbia ruled that the law is Constitutional.[197][198] The Constitutional Accountability Center remarked that this court consists of many conservative judges and they found the law constitutional.[198] Specifically, Senior Judge Lawrence Silberman, well known in conservative circles as a conservative intellectual, and who ruled that the District of Columbia's handgun law was unconstitutional, ruled that the law is constitutional. Silberman said "the right to be free from federal regulation is not absolute and yields to the imperative that Congress be free to forge national solutions to national problems".[197]

Federal District Court ruling from United States District Court for the Western District of Virginia

On November 30, 2010, U.S. District Court Judge Norman K. Moon, who sits in Virginia, also declared the individual mandate constitutional in Liberty University v. Geithner. He also declared the employer mandate constitutional. He rejected two other arguments that government lawyers have made in cases across the country in defending the new law: first, that no one has legal standing to bring challenges at this point to the 2014 mandates, and second that any such challenge is premature. He rejected the challengers' basic argument that Congress had no authority to order someone to give up their own desire not to buy a commercial product and force them into a market they do not want to enter. He said:

Regardless of whether one relies on an insurance policy, one's savings, or the backstop of free or reduced-cost emergency room services, one has made a choice regarding the method of payment for the health care services one expects to receive. Far from "inactivity", by choosing to forgo insurance, [individuals] are making an economic decision to try to pay for health care services later, out of pocket, rather than now, through the purchase of insurance ... As Congress found, the total incidence of these economic decisions has a substantial impact on the national market for health care by collectively shifting billions of dollars on to other market participants and driving up the prices of insurance policies.[199]Federal District Court ruling from the United States District of Columbia

On February 22, 2011, Judge Gladys Kessler of the U.S. District Court for the District of Columbia, rejected a challenge to the law in Meade v. Holder by five individuals who argued, among other things, that the Affordable Care Act violated the Religious Freedom Restoration Act, and that the individual mandate exceeded Congress's power under the Interstate Commerce Clause. Kessler rejected as "pure semantics" plaintiffs' argument that failing to acquire insurance was the regulation of inactivity, noting that "those who choose not to purchase health insurance will ultimately get a 'free ride' on the backs of those Americans who have made responsible choices to provide for the illness we all must face at some point in our lives." Kessler ruled that individual mandate was a valid exercise of Congress's power to regulate interstate commerce.[200][201]

Federal District Court ruling by the United States District Court for the Eastern District of Michigan

On October 8, 2010, U.S. District Court Judge George Caram Steeh in Thomas More Law Center v. Obama wrote that in his view the PPACA, including the individual mandate, was constitutional.[202] He rejected a private suit[203] filed by Michigan's Thomas More Law Center and several state residents that focused on the Commerce Clause, deciding that Congress had the power to pass the law because it affected interstate commerce and was part of a broader regulatory scheme.[204][205]

On June 29, 2011, a divided three-judge panel of the Sixth Circuit Court of Appeals affirmed the decision.[206] Judge Jeffrey Sutton, a member of the three judge panel appointed by George W. Bush, was the first Republican-appointed judge to rule that the law is constitutional.[207]

Repeal efforts

111th Congress

Reps. Steve King of Iowa and Michele Bachmann of Minnesota, both Republicans, introduced bills in the House to repeal the Act shortly after it was passed, as did Sen. Jim DeMint in the Senate.[208] None of the three bills was considered by either body.

112th Congress

In 2011, the Republican-controlled House of Representatives voted 245–189 to approve a bill entitled "Repealing the Job-Killing Health Care Law Act" (H.R.2), which, if enacted, would repeal the Patient Protection and Affordable Care Act and the health care-related text of the Health Care and Education Reconciliation Act of 2010. All Republicans and 3 Democrats voted for repeal.[209] In the Senate, the bill was offered as an amendment to an unrelated bill, and was subsequently voted down.[210] Before votes in both houses of the Congress took place, president Obama stated that he would veto the bill should it pass both chambers.[211] Democrats in the House proposed that repeal not take effect until a majority of the Senators and Representatives had opted out of the Federal Employees Health Benefits Program. The Republicans voted down this measure.[212]

Job consequences of repeal

A spokesman for Republican Majority Leader Eric Cantor stated, "This is a job-killing law, period. Anyone who argues otherwise is ignoring the construct of the health care law and the widely accepted facts."[213] The House Republican leadership justified its use of the term "job killing" by contending that the PPACA would lead to a loss of 650,000 jobs, and attributing that figure to a report by the Congressional Budget Office.[213] However, the CBO report specifically stated that the negative effect on jobs was because people would voluntarily choose to work less once they have health insurance outside of their jobs.[214] FactCheck noted that the 650,000 figure was not in the CBO report, and said that the Republican statement "badly misrepresents what the Congressional Budget Office has said about the law. In fact, CBO is among those saying the effect 'will probably be small.'"[213] The Republicans also cited a study by the National Federation of Independent Businesses, but PolitiFact.com said that the 2009 NFIB study had concerned an earlier version of the bill that differed significantly from what was enacted.[215] PolitiFact rated the Republican statement as False.[215]

Effect of repeal proposals on federal budget projections

The CBO estimated that repealing the entire PPACA (including both its taxing and spending provisions) would increase the net 2011-2021 federal deficit projections by $210 billion.[129] Others disagree, arguing that estimate was based on unrealistic assumptions; House Speaker John Boehner said, "I don't think anyone in this town believes that repealing Obamacare is going to increase the deficit."[216] In May 2011, CBO analyzed proposals to prevent the use of appropriated funds to implement the legislation, and wrote that "a temporary prohibition, extending through the remainder of fiscal year 2011, would reduce the budget deficit by about $1.4 billion in 2011 but would increase deficits by almost $6 billion over the 2011-2021 period... CBO cannot determine whether changes in spending under a permanent prohibition would produce net costs or net savings relative to its baseline projection, which assumes full implementation."[217]

Temporary waivers

Interim regulations have been put in place for a specific type of employer funded insurance, the so-called "mini-med" or limited benefit plans, which are low-cost to employers who buy them for their employees, but which cap coverage at a very low level. Such plans are sometimes offered to low-paid and part-time workers, for example in fast food restaurants or purchased direct from an insurer. Most company provided health insurance from September 23, 2010, may not set an annual coverage cap lower than $750,000,[218] a lower limit that is raised in stages until 2014, by which time no insurance caps are allowed at all. By 2014, no health insurance, whether sold in the individual or group market, will be allowed to place an annual cap on coverage. The waivers have been put in place to encourage employers and insurers offering mini-med plans not to withdraw medical coverage before the full regulations come into force (by which time small employers and individuals will be able to buy non-capped coverage through the exchanges) and are granted only if the employer can show that complying with the limit would mean a significant decrease in employees' benefits coverage or a significant increase in employees' premiums.[218]

Among those receiving waivers were employers, large insurers, such as Aetna and Cigna, and union plans, covering about one million employees; McDonald's, one of the employers which received a waiver, has 30,000 hourly employees whose plans have annual caps of $10,000. The waivers are issued for one year and can be reapplied for.[219][220] Referring to the adjustments as "a balancing act", Nancy-Ann DeParle, director of the Office of Health Reform at the White House, said, "The president wants to have a smooth glide path to 2014."[219] On January 26, 2011 HHS said it had to date granted a total of 733 waivers for 2011, covering 2.1 million people, or about 1% of the privately insured population.[221] In June 2011, the Obama Administration announced that all applications for new waivers and renewals of existing ones have to be filed by September 22 of that year, and no new waivers would be approved after this date.[222]

See also

- Comparison of Canadian and American health care systems

- Universal health care

- U.S. health care compared with 8 other countries in tabular form

- Massachusetts health care reform law ("Romneycare"), which served as a model for the Patient Protection and Affordable Care Act[223]

References

- ^ Elmendorf, Douglas W. (January 22, 2010). "Additional Information on the Effect of the Patient Protection and Affordable Care Act on the Hospital Insurance Trust Fund". Congressional Budget Office. http://www.cbo.gov/doc.cfm?index=11005. Retrieved 2010-03-31. "This letter responds to questions you posed about the Congressional Budget Office's (CBO's) analysis of the effects of H.R. 3590, the Patient Protection and Affordable Care Act (PPACA)"

- ^ Pub.L. 111-148, 124 Stat. 119, to be codified as amended at scattered sections of the Internal Revenue Code and in 42 U.S.C..

- ^ Review of U.S. Health Care Law from a Human Rights Perspective | Doctors for Global Health

- ^ "First Speech to a Joint Session of Congress". 24 February 2009. http://www.americanrhetoric.com/speeches/barackobama/barackobamajointsession2009.htm.

- ^ Keehan SP, Sisko AM, Truffer CJ, et al. (August 2011). "National health spending projections through 2020: economic recovery and reform drive faster spending growth". Health Aff (Millwood) 30 (8): 1594–605. doi:10.1377/hlthaff.2011.0662. PMID 21798885.

- ^ https://www.cms.gov/ActuarialStudies/Downloads/S_PPACA_2009-12-10.pdf

- ^ "CBO’s 2011 Long-Term Budget Outlook" June 2011. p. 44. Quote: "Through those changes and numerous others, the 2010 legislation significantly decreased Medicare outlays relative to what they would have been under prior law."

- ^ http://www.senate.gov/legislative/LIS/roll_call_lists/roll_call_vote_cfm.cfm?congress=111&session=1&vote=00396

- ^ http://clerk.house.gov/evs/2010/roll165.xml

- ^ http://www.reuters.com/article/2011/01/28/usa-healthcare-legal-idUSN2823552420110128

- ^ http://online.wsj.com/article/SB10001424053111904006104576504383685080762.html http://www.latimes.com/health/la-na-heathcare-ruling-20110909,0,3821769.story

- ^ http://www.time.com/time/politics/article/0,8599,2099414,00.html

- ^ a b Denniston, Lyle (November 14, 2011). "Court sets 5 1/2-hour hearing on health care". SCOTUSblog. http://www.scotusblog.com/2011/11/court-sets-5-12-hour-hearing-on-health-care/.

- ^ a b c "Private Health Insurance Provisions in PPACA (P.L. 111-148)". Congressional Research Service. April 15, 2010. http://bingaman.senate.gov/policy/crs_privhins.pdf.

- ^ http://www.bcbsm.com/healthreform/pubs/ppaca_insurance_reform_2014.pdf http://www.asjonline.com/Exclusives/2010/10/Pages/After-PPACA-The-Future-of-the-Health-Insurance-Underwriter.aspx http://www.nursingworld.org/MainMenuCategories/HealthcareandPolicyIssues/HealthSystemReform/Health-Care-Reform-Legislation-Timeline.aspx

- ^ http://www.perkinsaccounting.com/our-story/litigation-support-accounting-firm-newsroom/perkins-news-bulletin/health-insurance-legislation/health-insurance-legislation-mandates.html http://www.lexisnexis.com/community/emergingissues/blogs/spotlightonhealthcarereform/archive/2010/12/13/federal-judge-rejects-commerce-clause-argument-finds-ppaca-health-insurance-individual-mandate-is-unconstitutional.aspx

- ^ a b c d Galewitz, Phil (March 26, 2010). "Consumers Guide To Health Reform". Kaiser Health News. http://www.kaiserhealthnews.org/Stories/2010/March/22/consumers-guide-health-reform.aspx.

- ^ http://www.healthcarereformmagazine.com/article/health-reform-and-medicaid-expansion.html

- ^ http://www.familiesusa.org/assets/pdfs/health-reform/Enrollment-Policy-Provisions.pdf

- ^ http://www.healthcare.gov/law/provisions/exchanges/index.html

- ^ http://www.kff.org/healthreform/upload/7962-02.pdf

- ^ http://www.csmonitor.com/USA/Politics/2010/0320/Health-care-reform-bill-101-Who-gets-subsidized-insurance

- ^ http://www.hhs.gov/news/press/2011pres/07/20110711a.html http://www.naic.org/documents/committees_b_Exchanges.pdf http://www.familiesusa.org/health-reform-central/september-23/Annual-and-Lifetime-Limits.pdf

- ^ http://www.kff.org/healthreform/upload/7907.pdf

- ^ http://www.irs.gov/newsroom/article/0,,id=223666,00.html

- ^ http://www.healthcare.gov/news/factsheets/medical_loss_ratio.html

- ^ http://www.healthcare.gov/glossary/e/essential.html

- ^ http://www.shrm.org/Publications/HRNews/Pages/CoverPreventiveCare.aspx

- ^ http://www.medscape.com/viewarticle/748502

- ^ http://www.huronconsultinggroup.com/researchdetails.aspx?articleId=2577

- ^ http://www.nimh.nih.gov/about/director/2011/the-economics-of-health-care-reform.shtml

- ^ Peter Grier, Health care reform bill 101: Who will pay for reform?, Christian Science Monitor (March 21, 2010).

- ^ "Joint Committee On Taxation, March 20, 2010 (JCX-17-10)"

- ^ Patient Protection and Affordable Care Act from Wikisource.

- ^ "Key Points Of The Health Care Reform Bil". The Kentucky Post. http://www.kypost.com/mostpopular/story/Key-Points-Of-The-Health-Care-Reform-Bill/GYwbvispwEy36LI05K_9Cg.cspx. Retrieved 2010-03-22.[dead link]

- ^ a b c d e f g h i j k l m n o Binckes, Jeremy; Nick Wing (2010-03-22). "The Top 18 Immediate Effects Of The Health Care Bill". The Huffington Post. http://www.huffingtonpost.com/2010/03/22/the-top-18-immediate-effe_n_508315.html#s75147. Retrieved 2010-03-22.

- ^ Hossain, Farhana; Tse, Archie (March 23, 2010). "Comparing the House and the Senate Health Care Proposals". New York Times. http://www.nytimes.com/interactive/2009/11/19/us/politics/1119-plan-comparison.html. Retrieved May 21, 2010..

- ^ a b "Updated Health Care Charts". Committee for a Responsible Federal Budget. November 19, 2009. http://crfb.org/blogs/updated-health-care-charts..

- ^ a b c d e "Health Reform Implementation Timeline". Kaiser Family. http://www.kff.org/healthreform/8060.cfm. Retrieved 2010-03-30.

- ^ True or false? Top 7 health care fears - TODAY Health - TODAY.com

- ^ Grier, Peter (2010-03-24). "Health care reform bill 101: rules for preexisting conditions". The Christian Science Monitor. http://www.csmonitor.com/USA/Politics/2010/0324/Health-care-reform-bill-101-rules-for-preexisting-conditions. Retrieved 2010-03-25.

- ^ a b c Tergesen, Anne (June 5, 2010). "Insurance Relief for Early Retirees". The Wall Street Journal. http://online.wsj.com/article/SB127570667448201583.html?KEYWORDS=high-risk+pool+health+insurance.

- ^ "Kaiser: High-Risk Pool Provisions under the Health Reform Law". http://www.kff.org/healthreform/upload/8066.pdf.

- ^ Hilzenrath, David S. (May 4, 2010). "18 states refuse to run insurance pools for those with preexisting conditions". The Washington Post. http://www.washingtonpost.com/wp-dyn/content/article/2010/05/03/AR2010050304072.html.

- ^ "Patient Protection and Affordable Care Act/Title IV/Subtitle A/Sec. 4001. National Prevention, Health Promotion and Public Health Council". http://en.wikisource.org/wiki/Patient_Protection_and_Affordable_Care_Act/Title_IV#Subtitle_A.

- ^ Executive Order 13544 - Establishing the National Prevention, Health Promotion, and Public Health Council, June 10, 2010, Vol. 75, No. 114, 75 F.R. 33983

- ^ "Health-Care Changes to Start Taking Effect This Year". http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aa32kl.M09T4.

- ^ Provisions of the Affordable Care Act, By Year | HealthCare.gov

- ^ H.R. 3590 Enrolled, section 1001 (adding section 2714 to the Public Health Service Act): "A group health plan and a health insurance issuer offering group or individual health insurance coverage that provides dependent coverage of children shall continue to make such coverage available for an adult child (who is not married) until the child turns 26 years of age."

- ^ Pear, Robert (May 10, 2010). "Rules Let Youths Stay on Parents’ Insurance". New York Times. http://www.nytimes.com/2010/05/11/health/policy/11health.html.

- ^ "Young Adults and the Affordable Care Act: Protecting Young Adults and Eliminating Burdens on Families and Businesses" (Press release). Executive Office of the President of the United States. http://www.whitehouse.gov/sites/default/files/rss_viewer/fact_sheet_young_adults_may10.pdf.

- ^ Note: Language in the law concerning this provision has been described as ambiguous, but representatives of the insurance industry have indicated they will comply with regulations to be issued by the Secretary of Health and Human Services reflecting this interpretation.

- Pear, Robert (March 28, 2010). "Coverage Now for Sick Children? Check Fine Print". The New York Times. http://www.nytimes.com/2010/03/29/health/policy/29health.html. Retrieved April 8, 2010

- Holland, Steve (March 29, 2010). "Obama administration has blunt message for insurers". Reuters. http://www.reuters.com/article/idUSN2017888120100329. Retrieved April 8, 2010

- Pear, Robert (March 30, 2010). "Insurers to Comply With Rules on Children". The New York Times. http://www.nytimes.com/2010/03/31/health/policy/31health.html. Retrieved April 8, 2010

- Alonso-Zaldivar, Ricardo (March 24, 2010). "Gap in Health Care Law's Protection for Children". ABC News. Associated Press. http://abcnews.go.com/Business/wireStory?id=10186800. Retrieved April 8, 2010.

- ^ U.S. Department of Health and Human Services (June 28, 2010). "Patient Protection and Affordable Care Act; Requirements for Group Health Plans and Health Insurance Issuers Under the Patient Protection and Affordable Care Act Relating to Preexisting Condition Exclusions, Lifetime and Annual Limits, Rescissions, and Patient Protections; Final Rule and Proposed Rule". Federal Register 75 (123): 37187–37241. http://edocket.access.gpo.gov/2010/2010-15278.htm. Retrieved July 26, 2010.

- ^ Bowman, Lee (2010-03-22). "Health reform bill will cause several near-term changes". Scripps Howard News Service. http://public.shns.com/node/52359. Retrieved 2010-03-23.

- ^ Rao, Smriti (2010-03-22). "Health-Care Reform Passed. So What Does It Mean?". 80beats (Discover). http://blogs.discovermagazine.com/80beats/2010/03/22/health-care-reform-passed-so-what-does-it-mean/. Retrieved 2010-03-23.

- ^ Public Law 111 - 148, sec. 10101(f), adding Sec. 2718. Bringing down the cost of health care coverage of the Public Health Service Act.

- ^ Center for Medicare and Medicaid Innovation, http://healthreformgps.org/resources/center-for-medicare-and-medicaid-innovation/.

- ^ "IRS Issues Guidance Explaining 2011 Changes to Flexible Spending Arrangements". www.irs.gov. http://www.irs.gov/irs/article/0,,id=227301,00.html. Retrieved 2010-09-15.

- ^ Smith, Donna (March 19, 2010). "FACTBOX-US healthcare bill would provide immediate benefits". Reuters. http://www.reuters.com/article/idUSN1914020220100319.

- ^ http://www.irs.gov/pub/irs-drop/n-2010-69.pdf

- ^ "Repealing the 1099 Reporting Requirement: A Big Win for Small Business". http://www.whitehouse.gov/blog/2011/04/14/repealing-1099-reporting-requirement-big-win-small-business.

- ^ a b "Obama Signs Law Repealing Business Tax Reporting Mandate". http://www.bloomberg.com/news/2011-04-14/obama-signs-law-repealing-business-tax-reporting-mandate-1-.html.

- ^ "Instructions for Form 1099-MISC". http://www.irs.gov/pub/irs-pdf/i1099msc.pdf.

- ^ a b "U.S. Government Printing Office". http://www.gpo.gov:80/fdsys/pkg/PLAW-111publ148/html/PLAW-111publ148.htm.

- ^ "Healthcare Law Includes Tax Credit, Form 1099 Requirement". http://www.ppbmag.com/Article.aspx?id=5436.

- ^ "Health Care Bill Brings Major 1099 Changes". http://www.theapchannel.com/accounts-payable/node/522.

- ^ "Costly changes to 1099 reporting in health care law". http://www.accountingweb.com/topic/tax/costly-changes-1099-reporting-health-care-bill.

- ^ "PPACA, section 9015 as modified by section 10906". http://www.gpo.gov/fdsys/pkg/BILLS-111hr3590enr/pdf/BILLS-111hr3590enr.pdf.

- ^ "HCERA section 1402". http://www.gpo.gov/fdsys/pkg/BILLS-111hr4872enr/pdf/BILLS-111hr4872enr.pdf.

- ^ Alonso-Zaldivar, Ricardo (March 24, 2010). "Gap in Health Care Law's Protection for Children". ABC News. Associated Press. http://abcnews.go.com/Business/wireStory?id=10186800. Retrieved 2010-04-07.

- ^ a b c d Downey , Jamie (March 24, 2010). "Tax implications of health care reform legislation". Boston Globe. http://www.boston.com/business/personalfinance/managingyourmoney/archives/2010/03/tax_implication.html. Retrieved 2010-03-25.

- ^ a b "5 key things to remember about health care reform". CNN. March 25, 2010. http://www.cnn.com/2010/HEALTH/03/25/health.care.law.basics/index.html. Retrieved May 21, 2010.

- ^ Peterson, Chris L. & Chaikind, Hinda (April 20, 2010), Summary of Small Business Health Insurance Tax Credit Under PPACA (P.L. 111-148), Congressional Research Service, p. 3 (Table 2), http://healthreform.kff.org/~/media/Files/KHS/docfinder/crssmallbusinesscredit.pdf, retrieved February 23, 2011

- ^ McNamara, Kristen (March 25, 2010), "What Health Overhaul Means for Small Businesses", The Wall Street Journal

- ^ http://www.boston.com/news/nation/washington/articles/2011/10/17/ruling_could_speed_repeal_of_long_term_care_plan/

- ^ http://thehill.com/blogs/healthwatch/health-reform-implementation/187949-white-house-opposes-formal-class-act-repeal

- ^ "Carney: Health insurance law will benefit senior citizens". The Daily Item (Sunbury, Pennsylvania). March 26, 2010. http://www.dailyitem.com/0100_news/local_story_084233554.html.

- ^ http://www.cnn.com/2011/10/14/politics/health-care-program/

- ^ "Health Reform, Point by Point - Bills Compared". Wall Street Journal. March 22, 2010. http://online.wsj.com/public/resources/documents/st_healthcareproposals_20090912.html. Retrieved 2010-04-07.

- ^ Burkes, Paula (November 8, 2009). "Medical Expense Accounts Could be Limited to $2,500". The Oklahoman. http://savemyflexplan.org/media_news/09-11-08_oklahoman.html..

- ^ Spencer, Jean (2010-03-22). "Menu Measure: Health Bill Requires Calorie Disclosure". The Wall Street Journal. http://blogs.wsj.com/washwire/2010/03/22/menu-measure-health-bill-requires-calorie-disclosure/. Retrieved 2010-03-23.

- ^ Galewitz, Phil (2010-03-22). "Health reform and you: A new guide". Kaiser Health News (MSNBC). http://today.msnbc.msn.com/id/34609984/ns/health-health_care/. Retrieved 2010-03-23.

- ^ "Health Care Reform Bill 101". The Christian Science Monitor. http://www.csmonitor.com/USA/Politics/2010/0320/Health-care-reform-bill-101-Who-gets-subsidized-insurance.

- ^ "Patient Protection and Affordable Care Act/Title I/Subtitle E/Part I/Subpart A". http://en.wikisource.org/wiki/Patient_Protection_and_Affordable_Care_Act/Title_I/Subtitle_E/Part_I/Subpart_A.

- ^ Patient Protection and Affordable Care Act: Title I: Subtitle E: Part I: Subpart A: Premium Calculation

- ^ "Refundable Tax Credit". http://hungerreport.org/2010/report/chapters/two/taxes/refundable-tax-credits.

- ^ a b "Health Insurance Premiums (DHHS)". DHHS, see history at http://www.samhsa.gov/Financing/post/Health-Insurance-Premiums-Past-High-Costs-Will-Become-the-Present-and-Future-Without-Health-Reform.aspx. January 28, 2011. http://www.healthcare.gov/law/resources/reports/premiums01282011a.pdf.

- ^ "Health Insurance Premium Credits Under PPACA". =Congressional Research Service. April 28, 2010. http://hrsa.dshs.wa.gov/MedicaidHealthCareReform/CRS/HealthInsurancePremiumCredits.pdf.

- ^ a b "Treasury Lays the Foundation to Deliver Tax Credits". http://www.treasury.gov/press-center/Documents/36BFactSheet.PDF.

- ^ "An Analysis of Health Insurance Premiums Under the Patient Protection and Affordable Care Act". http://www.cbo.gov/doc.cfm?index=10781.

- ^ "Policies to Improve Affordability and Accountability". The White House. http://www.whitehouse.gov/health-care-meeting/proposal/whatsnew/affordability.

- ^ "Kaiser Family Foundation:Health Reform Subsidy Calculator – Premium Assistance for Coverage in Exchanges/Gateways". http://healthreform.kff.org/SubsidyCalculator.aspx.

- ^ "Affordable Insurance Exchanges". http://cciio.cms.gov/programs/exchanges/index.html.

- ^ a b "Proposed Rules Cover Enrollment, Medicaid Eligibility, Premium Tax Credits". http://www.bna.com/proposed-rules-cover-n12884903111/.

- ^ "Government lays out health insurance exchange details". Reuters. August 12, 2011. http://www.reuters.com/article/2011/08/12/us-usa-health-exchanges-idUSTRE77B4P920110812.

- ^ Public Law 111 - 148, section 1312: "... the only health plans that the Federal Government may make available to Members of Congress and congressional staff with respect to their service as a Member of Congress or congressional staff shall be health plans that are (I) created under this Act (or an amendment made by this Act); or (II) offered through an Exchange established under this Act (or an amendment made by this Act)."

- ^ "Health Care reform Reconciliation Act". http://www.healthcare.gov/center/authorities/reconciliation_law.pdf.

- ^ Krantz, Matt (March 24, 2010). "Highlights of the Tax Provisions in Health Care Reform". Accuracy in Media. http://www.usatoday.com/money/perfi/taxes/2010-03-24-investtax24_ST_N.htm. Retrieved May 21, 2010.

- ^ a b Public Law 111 - 148, section 1332.

- ^ a b Goldstein, Amy; Balz, Dan (March 1, 2011). "Obama offers states more flexibility in health-care law". The Washington Post. http://www.washingtonpost.com/wp-dyn/content/article/2011/02/28/AR2011022806535.html.

- ^ "Wyden: Health Care Lawsuits Moot, States Can Opt Out Of Mandate". HuffingtonPost.com. March 24, 2010. http://www.huffingtonpost.com/2010/03/24/wyden-health-care-lawsuit_n_511748.html. Retrieved March 27, 2010.

- ^ Preparing for Innovation: Proposed Process for States to Adopt Innovative Strategies to Meet the Goals of the Affordable Care Act | HealthCare.gov

- ^ Gov. Shumlin issued the following statement on health care rules | The Official Website of the Governor of Vemont

- ^ Health Reform Flexibility and the Wyden-Brown Waiver for State Innovation | Bipartisan Policy Center

- ^ Vermont Becomes First State to Enact Single-Payer Health Care - National - The Atlantic Wire

- ^ Vermont Single-Payer Health Care Law Signed By Governor

- ^ Affordable Care Act One Year Later - Policy and Medicine

- ^ Gold, Jenny (2010-01-15). "'Cadillac' Insurance Plans Explained". Kaiser Health News. http://www.kaiserhealthnews.org/Stories/2010/March/18/Cadillac-Tax-Explainer-Update.aspx.

- ^ "H.R. 4872, THE HEALTH CARE & EDUCATION AFFORDABILITY RECONCILIATION ACT of 2010 IMPLEMENTATION TIMELINE". US House COMMITTEES ON WAYS & MEANS, ENERGY & COMMERCE, AND EDUCATION & LABOR. March 18, 2010. pp. 7. http://docs.house.gov/energycommerce/TIMELINE.pdf. Retrieved March 24, 2010.

- ^ Congressional Budget Office, Cost Estimates for H.R. 4872, Reconciliation Act of 2010 (Final Health Care Legislation) March 20, 2010).

- ^ http://www.bloomberg.com/news/2011-10-14/u-s-won-t-start-class-long-term-care-insurance-sebelius-says.html

- ^ a b c "Correction Regarding the Longer-Term Effects of the Manager's Amendment to the Patient Protection and Affordable Care Act" (PDF). Congressional Budget Office. December 19, 2009. http://www.cbo.gov/ftpdocs/108xx/doc10868/12-19-Reid_Letter_Managers_Correction_Noted.pdf. Retrieved March 22, 2010.

- ^ CNN (March 18, 2010). "Where does health care reform stand?". http://www.cnn.com/2010/POLITICS/03/18/health.care.latest/index.html. Retrieved May 12, 2010.

- ^ Farley, Robert (March 18, 2010). "Pelosi: CBO says health reform bill would cut deficits by $1.2 trillion in second decade". PolitiFact (St. Petersburg Times). http://www.politifact.com/truth-o-meter/statements/2010/mar/18/nancy-pelosi/pelosi-cbo-says-health-reform-bill-would-cut-defic/. Retrieved 2010-04-07.

- ^ http://www.cbo.gov/ftpdocs/113xx/doc11376/RyanLtrhr4872.pdf

- ^ Sen. Tom Coburn: Obamacare PR campaign anchored in spin, not reality | The Examiner | Op Eds | Washington Examiner

- ^ Obamacare’s Cooked Books and the ‘Doc Fix’ - By James C. Capretta - Critical Condition - National Review Online

- ^ GOP Might Target ObamaCare As Part Of A Medicare 'Doc Fix' - Investors.com

- ^ An Analysis of the Senate Democrats' Health Care Bill | The Heritage Foundation

- ^ "H.R. 4872, Reconciliation Act of 2010" (PDF). Congressional Budget Office. March 18, 2010. http://www.cbo.gov/ftpdocs/113xx/doc11355/hr4872.pdf. Retrieved March 22, 2010..

- ^ Dennis, Steven (March 18, 2010). "CBO: Health Care Overhaul Would Cost $940 Billion". Roll Call (Economist Group). http://www.rollcall.com/news/44347-1.html. Retrieved March 22, 2010.

- ^ Klein, Ezra (March 22, 2010). "What does the health-care bill do in its first year?". Washington Post. http://voices.washingtonpost.com/ezra-klein/2010/03/what_does_the_health-care_refo.html.

- ^ Uwe Reinhardt (March 24, 2010). "Wrapping Your Head Around the Health Bill". The New York Times. http://economix.blogs.nytimes.com/2010/03/24/wrapping-your-head-around-the-health-bill/. Retrieved October 9, 2010.

- ^ Holtz-Eakin, Douglas (March 21, 2010). "The Real Arithmetic of Health Care Reform". The New York Times. http://www.nytimes.com/2010/03/21/opinion/21holtz-eakin.html.

- ^ Health Care | Committee On The Budget

- ^ Repealing Job-Killing Health Care Law “First Step Toward Fiscal Sanity” | Speaker of the House John Boehner | speaker.gov

- ^ MYTHBUSTER - CMS Actuary Debunks GOP Talking Point on Health Reform and the Deficit| Commmittee on the Budget | United States House of Representatives

- ^ Health Care Repeal Balloons Deficit, Hurts Economy and Families| Commmittee on the Budget | United States House of Representatives

- ^ a b Heavey, Susan (February 18, 2011), "Repealing healthcare law would cost $210 bln: CBO", Reuters, retrieved March 13, 2011

- ^ Noam Scheiber (September 17, 2009). "Is the CBO Biased Against Health Care Reform?". The New Republic. http://www.tnr.com/blog/the-stash/the-cbo-biased-against-health-care-reform.

- ^ a b Jonathan Cohn (January 21, 2011). "The GOP's Trick Play". The New Republic. http://www.tnr.com/blog/jonathan-cohn/81941/trick-play.

- ^ James, Frank (March 19, 2010). "Health Overhaul Another Promise U.S. Can't Afford: Expert". The Two-Way (National Public Radio). http://www.npr.org/blogs/thetwo-way/2010/03/health_overhaul_another_promis.html. Retrieved 2010-04-07.

- ^ "Congress Has Good Record of Implementing Medicare Savings". CBPP. http://www.cbpp.org/cms/index.cfm?fa=view&id=3021. Retrieved 2010-03-28.

- ^ "Can Congress cut Medicare costs?". voices.washingtonpost.com. http://voices.washingtonpost.com/ezra-klein/2009/12/can_congress_cut_medicare_cost.html. Retrieved 2010-03-28.

- ^ a b "Cost Estimate for Pending Health Care Legislation". Congressional Budget Office. March 20, 2010. http://cboblog.cbo.gov/?p=546. Retrieved March 28, 2010.

- ^ Siskin, Alison (March 22, 2011). Treatment of Noncitizens Under the Patient Protection and Affordable Care Act. Congressional Research Service. R41714. http://www.ciab.com/WorkArea/DownloadAsset.aspx?id=2189. Retrieved October 14, 2011.

- ^ Chaikind, Hinda; Copeland, Curtis W.; Redhead, C. Stephen; Staman, Jennifer (March 2, 2011). PPACA: A Brief Overview of the Law, Implementation, and Legal Challenges. Congressional Research Service. R41664. http://www.nationalaglawcenter.org/assets/crs/R41664.pdf. Retrieved October 14, 2011.

- ^ a b c Trumbull, Mark (March 23, 2010). "Obama signs health care bill: Who won't be covered?". The Christian Science Monitor. http://www.csmonitor.com/USA/2010/0323/Obama-signs-health-care-bill-Who-won-t-be-covered. Retrieved March 24, 2010.

- ^ Levey, Noam N. (December 27, 2010). "More small businesses are offering health benefits to workers". Los Angeles Times. http://www.latimes.com/health/healthcare/la-fi-health-coverage-20101227,0,5024491.story.